This is a pretty big one.. No I didn't go off radar, I've been browsing and collecting charts.

For short term timeframes, I'm giving you a larger historical look when possible.

DIA 1 min-the DIA and confirmed by the same signals in the Dow-30 has been one of the worst looking averages since this last rally started, you'll see why. The 1 min has been lagging for awhile, even longer then I boxed, compare to the last top in the yellow box. This is why I said last week, we have some good signs for a strong rally and in fact it was what has been expected for October, but the overbought condition has the potential of creating a very nasty snap back and this is why I wanted to see an orderly pullback last week rather then add to overbought tensions.

The 2 min looks worse, compare to the last top and the depth chart.

The 5 min only had a few days of inline status before going leading negative.

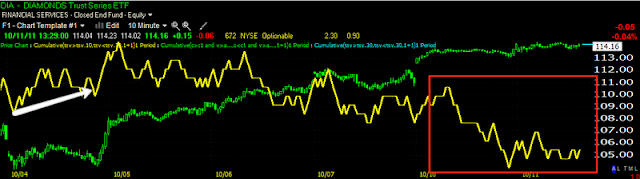

I can't show as much history on the 10 min chart because of the platform, but it is leading negative/

This is the worst looking 15 min chart and a near mirror opposite to the SPY 15 min chart.

Even the 30 min is now getting negative

And the 60 min is leading negative. This is not unique to the DIA, look at the Dow-30 below in the same timeframe.

DJ-30 60 min.

The IWM is leading negative on the 1 min-compare to the last top, this looks a lot worse.

The 2 min is a relative negative divergence.

The 5 min is leading negative, also compare to the last top on a relative and leading basis.

Now the IWM 15 has fallen out of line to a leading negative.

The 30 min is a relative negative. This what I did not want to see happen to the uptrend.

IWM 60 min had a decent base, it's still in line.

QQQ 1 min is not only leading negative, but hitting new lows.

QQQ 2 min leading negative

QQQ 5 min-same

QQQ 10 min is close enough to leading negative

The 15 min is leading negative, even though it has tried to stay in line within that divergence.

QQQ 60 min is just starting to fall out of line.

SPY 1 min has completely fallen apart the last 2 days.

The 2 min looks horrible

The 5 min is leading negative over the last 2-3 days.

Only the 15 min chart, which I have said all along is by far the strongest 15 min chart we have seen in months, still looks decent.

A closer look though shows some recent deterioration.

The 30/60 min SPY are still okay.

I have more coming, chew over these for a minute.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment