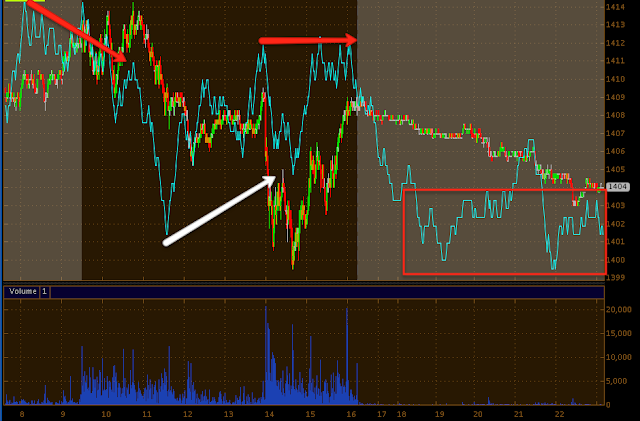

ES remains in a leading negative divergence in after hours trade.

So far, although we still have a long night, this has kept US and almost all futures red across the board, notably the US and the EU.

The EUR/USD pair, at the green arrow is the point when the market bounced late in the day, the red arrow is the close at 4 pm. Since the $USD has broken above resistance (seen here with the EUR breaking below support). There was a test of support for the $USD that passed and further gains, this should be weighing on ES Futures, but the depth of the divergence in CONTEXT is partly due to the excessive bounce in the market this afternoon up to ES's VWAP, the currency arbitrage clearly didn't support that kind of a knee jerk move.

Th $AUD with excellent correlation and a great leading indicator has also broken down below support, again the $USD rising, deepening the already deepest divergence seen between the $AUD and SPX/market.

There's a fund that a member told me about that I had forgotten about that has acted as a leading indicator for the market, I took a look tonight, it is FCT. If I could remember who sent it to me, I'd give credit where it is due.

on this 2 day chart, FCT declined before the market in 2007, it also bottomed before the market in 2009, then it topped first in 2011 and is now negatively divergent with the SPX

2011-present, again FCT topped before the SPX's July crash and bottomed at the end of the crash first, on a relative basis, the SPX is above the 2011 high, FCT should currently be at the green trendline, it is lagging the market again.

What brought my attention was the last 3 days of very ugly closes, all very long wicked candles, higher prices being rejected and a close today just barely off the lows.

Here are tomorrow's economic events in the US

MBA Purchase Applications

7:00 AM ET

7:00 AM ET

Challenger Job-Cut Report

7:30 AM ET

7:30 AM ET

ADP Employment Report

![[Report]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_sLM8L1gdadnBg9zhywwzYDln-3pX2gsyNEW08rdaslY5ddspWgWirIOO3mVX1-JtKPyQLGdL2MwjMrOArvh1IzV_18GEiJIbSekn5O47MhHrCX6hWVti1Hy1qne-W5DQ-Sh628Msc=s0-d)

![[djStar]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_vIEOkuo49VodNjmRgT_VtW140qeiDqgKSNt8YrhtCCEpfsshmzT0C7IQVm22tFAtWyxMT5qlIzoF_k5T3tMfNiuRq66hpwmcKiwfLPD6yOMuQ8wMUgEnRKs0B0=s0-d) 8:15 AM ET

8:15 AM ET

ISM Non-Mfg Index

![[Report]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_sLM8L1gdadnBg9zhywwzYDln-3pX2gsyNEW08rdaslY5ddspWgWirIOO3mVX1-JtKPyQLGdL2MwjMrOArvh1IzV_18GEiJIbSekn5O47MhHrCX6hWVti1Hy1qne-W5DQ-Sh628Msc=s0-d)

![[djStar]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_vIEOkuo49VodNjmRgT_VtW140qeiDqgKSNt8YrhtCCEpfsshmzT0C7IQVm22tFAtWyxMT5qlIzoF_k5T3tMfNiuRq66hpwmcKiwfLPD6yOMuQ8wMUgEnRKs0B0=s0-d) 10:00 AM ET

10:00 AM ET

EIA Petroleum Status Report

![[djStar]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_vIEOkuo49VodNjmRgT_VtW140qeiDqgKSNt8YrhtCCEpfsshmzT0C7IQVm22tFAtWyxMT5qlIzoF_k5T3tMfNiuRq66hpwmcKiwfLPD6yOMuQ8wMUgEnRKs0B0=s0-d) 10:30 AM ET

10:30 AM ET

John Williams Speaks11:00 AM ET

ADP will catch some attention even though it is very noisy and often far off base, but even as the market is closed Friday, Non-Farm Payrolls will be out at 8:30 a.m. and the recent economic reports, especially in the sub-indicies have all been leaning toward a disappointing NFP print on Friday. ISM will also be an important report.

San Francisco Federal Reserve Bank Pres. John Williams speaks to San Francisco Planning and Urban Research business breakfast. Afterward he will take questions from the audience and the media. I doubt we get anything too heavy related to QE, but who knows, both Plosser and Fisher were skeptical of more easing, it may be his turn to weigh in.

| |

No comments:

Post a Comment