That move at the end of the day seemed like an intraday move similar to yesterday's, however some surprising timeframes were effected.

This is from yesterday's first market update around 11:15 a.m.

"I would think and there are some hints, that the market would need to halt this move up, perhaps pullback a bit intraday or consolidate if positive divergences/accumulation are to continue. Smart Money doesn't typically accumulate in to higher prices."

The DIA 15 min was moved to a new leading high, I don't think that strong divergence would have been possible without a move lower.

The DIA 60 min chart moved on that divergence, I know it looks small, but to move a 60 min chart in such a short period of time typically takes some very significant underlying action.

IWM 2 min leading positive at a new high, but take a look if I back the same chart up to 3:30

Note that price is lower, almost all of that leading positive divergence was done in a "U" shaped base in the afternoon.

IWM 15 min chart saw a strong leading positive divergence at the same area.

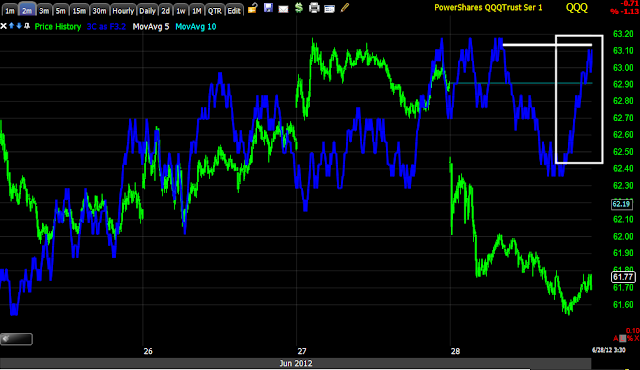

QQQ 2 min leading positive

The same chart backed up to before the market rallied.

QQQ 15 min chart remained in leading positive position and created a new leading high over the last 2 days even though price was lower.

SPY 1 min leading positive position, but note where 3C as yesterday at the highs, as I said at the start of the post, smart money doesn't usually accumulate in to higher prices, therefore we need a pullback to see continued improvement in the chart, this is why I called it a "constructive pullback".

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment