As for the newer GLD April monthly Call entered Friday I said in that very post,

"I know this is not good risk management and I don't encourage it, but I feel I have to go for it.

I went with April 20th (Friday 19th) monthly expiration, long $150 calls, full size."

Now this is my own personal preference with regard to how to use options, I don't look at them as a lottery ticket to score 200% gains, I look at them as a tool to increase the leverage on a good looking trade that might not otherwise be as attractive to me due to a risk:reward imbalance.

If I like a position longer term, I'm usually going to use an expiration that is about double the length I think I need and I prefer an in the money strike so I'm not taking options positions that are going to give me the highest reward, I'm going for ones that I think will let the trade work, that are a bit more quality and make the risk:reward balance more appealing.

Having two full size option positions in GLD (March and April) is not good risk management in my view, so if I need to trim one down, I'm going to trim down the March as the April gives me more time and it's already up nearly 25% in a day.

Here's what I see in GLD that made it seem reasonable to take action on the March position now...

As far as the historical Precious metal/$USD relationship...

GLD in green vs the $USD (UUP) in red makes sense at the white arrows, where Gold/GLD is starting to move to the upside is where the historical relationship (this obviously has not been a hard and fast rule, especially the last 4 years) makes less sense and is part of the reason I think Gold is up to something entirely different, the COMEX lowering of margin on the PM's as well also had me a bit suspicious something more was going on; I don't know what that is, I'm just following the charts and I'm sure we'll find out later, but for now it's not important to me.

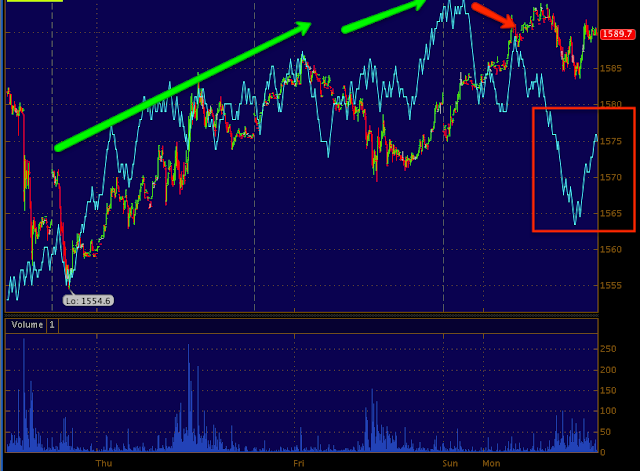

This is today's loss of momentum which would theoretically hit the March options a bit more than April with regard to time decay, so this looked like a good area to make the switch off.

"IF" gold/GLD fills this gap, this may be an excellent spot to add to a position or start a new position, we want to make sure though that the signals at that point are still positive and then enter any trades you might feel appropriate.

On an intraday 1 min 3C chart the green arrows show confirmation of the 3C/Price trend, in red they show a minor negative divergence which is often associated with a consolidation when it's on the 1 min chart only.

When it can be found on a more important 2 min or 3 min chart, then the probabilities are higher we see a pullback and I'd guess that would be a gap fill.

At 5 mins we have the first timeframe where we see more important institutional movement and this is a beautiful, strong leading positive divergence in 3C, so strategically I like GLD, very short term tactically I want to look at price weakness as an entry in to a position.

When we get to a 30 min chart with a leading positive divergence like this one of GLD, we are looking at a very strong positive divergence or strong bullish signal for GLD moving forward.

As for the YG/Gold E-mini Futures...

This is what the 5 min 3C chart looked like last week in the gold futures, a very positive leading divergence so this is why we wanted to enter long (call options) positions in Gold/GLD. Now fast forward to present...

At the green arrows we have price/3C trend confirmation, but at the red area today, we have a negative divergence, the probabilities are for a consolidation which can happen through time with price consolidating laterally or through price with a pullback. Given the GLD charts and the gap below, I favor the probability of a price pullback which opens up opportunity for those who may want to establish a long gold position, especially as the more important , longer term charts look so good.

This is the YG/gold futures 60 min chart showing a negative divergence in red at the highs sending gold lower and a positive divergence in to the lows which I believe will send Gold higher from here as we move forward.

What we are really looking at with the different timeframes are probabilities of what happens short term (intraday or a day or two) and longer term-perhaps weeks, months even. I look at this as strategic vs. tactical, the longer term positive disposition is the strategic view, a short term pullback offers an excellent tactical entry.

We'll keep an eye on what's going on and see if there's a decent tactical entry, but I still like Gold very much going forward.

No comments:

Post a Comment