Cyprus' president, Anastasiades (I've given up on trying to remember his name), said to Olli Rehn ( European Commissioner for Economic and Monetary Affairs and the Euro and vice president of the European Commission),

“When I warned you that there would not be a parliamentary majority to pass the agreement, you didn’t want to listen. Give my regards to Mrs Merkel.”

This is one of those comments my friends and I would read and say, "Oh Snap!"

Bad blood? Sounds like it.

For a timeline of events, check this Reuters article, it's actually fascinating how many temper tantrums there were and other EU officials just playing games on their smart phones in the corridors-maybe if they were using the calculator instead?

Anastasiades also delivered the same message to a CDU official close to Merkel according to Ekathimerini.com ,

"Anastasiades is also reported to have spoken to German MEP Elmar Brok, a member of Chancellor Angela Merkel’s CDU party who is close to the German leader.

According to Mega TV, Anastasiades is reported to have said to Rehn and Brok: “When I warned you that there would not be a parliamentary majority to pass the agreement, you didn’t want to listen. Give my regards to Mrs Merkel.”Oh Snap!

In any case, however things happened (ALWAYS BELIVE WHAT YOU READ), one thing seems sure from the moment I saw the market open, it seems someone promised market makers, specialists and others who would have been otherwise caught with a massive 2% gap open loss, to keep their mouths shut and actions in line with "normal" quad-witching and if that is done, you'll not only get back to the gap, but the old NYSE trick of opening the market at the lows, the specialists buys the lows and then sells the reversal, was the old trick pulled out as is is obvious from at least Saxo-Bank president that he had heard these rumors earlier in the week.

What makes me say this? First of all this is a general concept/theory, how it all went down is anyone's guess, but looking at the open and the high degree of correlation among risk asset classes, everything was in place to get back to the gap, I've never seen anyone so eager to buy the gap down open of such an uncertain situation and believe they would not have without assurances and while we got back to the gap (pretty much) and seemed to have a somewhat normal day, there are some strong signals that this was not the case and I will show you all of this, you can probably fill in some blanks from there.

One more thing, understand that any hint of a rumor of this getting out would have seen billions pulled out of Cypriot banks instantly rendering the entire rescue plan (that supposedly would have or may still see their two largest banks fail as early as their opening this week), if the deposits aren't there, then the rate or percentage increases to whatever it needs to be to get to the theft of $5.3 billion dollars from private savers.

First the opening divergences...

DIA 1 min

QQQ 1 min

SPY 1 min-

All 3 went from leading negative divergences to VERY strong leading positive divergences right on the open and price did its thing from there, you don't have to fill the gap, just do what NYSE specialists do (as they chose the opening price unlike the market demand at the NASDAQ-that's right, the NYSE specialist choses the opening price based on their assessment of demand and they even chose when to open a particular stock-it doesn't have to be at 9:30-I've been burned before), chose a low open in which you think will be the lows, buy it, ride it and dump it-instant profits and a technique day traders use to use when trading the NYSE.

As for the incredible amount of risk asset correlation, there's almost no possible way to see this kind of thing without something going on, first CONTEXT...

The ES model is never more than 4 points away from ES and most of the time around 2 points, this tells us risk assets were highly correlated. If we jump to our Leading Indicators/Risk Asset layout, this can be seen clearly, although I suspect it will look much different tomorrow.

All assets are compared to the SPX unless otherwise noted.

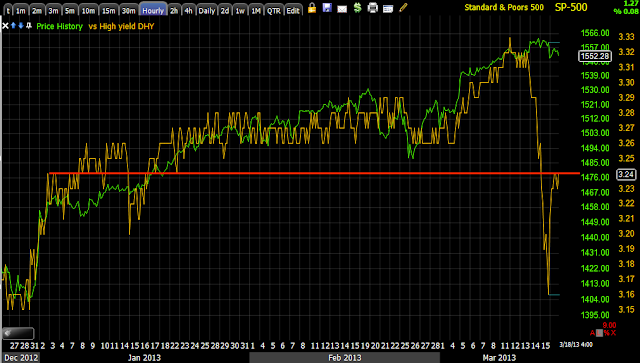

The longer term chart for the year of High Yield Credit which erased all 2013 gins in 2 days last Thursday and Friday-talk about volatility, but it was ramped today with other risk assets for the express purpose of filling in the gap in my opinion, which I held early today and posted it.

HY Credit intraday is humming right along with the SPX today, looks a lot different than Friday and from a quick eyeball, has still lost all of 2013's gains.

The Euro, even though it took a real beating and didn't quite make $1.30, was pretty close to in line with the SPX.

Longer term, the correlation that was once like glue is now deeply dislocated, this can't be viewed as anything other than bearish as it sends the $USD higher which pressures nearly every risk asset class.

HIO longer term is severely dislocated with the SPX as traders have moved away from High Yielding Income.

Ooops, this is out of order, but High Yield Corp. credit intraday is moving right along with the SPX and even trying to hold it up at the EOD.

Here's HIO intraday, also stuck to the SPX, unlike last week or most of the year.

Junk Credit which is also longer term dislocated from the SPX is also moving right along with all other risk assets, even the close is unique in that they all look almost exactly the same.

Here's HYG longer term, it's dislocated, Junk looks the same.

However there wasn't much demand for the goods that are needed to make things for a happy economy as you can see in commodities and Dr. Copper.

Commodities intraday vs the SPX

Commods on a longer term basis are also negatively dislocated.

Dr. copper isn't bid, it wasn't needed and there isn't any demand, maybe some demand for the slightly heavier and more yellow metal though as you'll see.

Dr. Copper vs. the SPX longer term.

As for currencies...

The $USD seemed to kill the party at the close, as it broke above some intraday resistance, the SPX lost ground even though risk assets held their bid.

Bigger view of the $USD, as I thought, in devaluation, the Dollar gets bought.

Speaking of which, the Yen intraday vs the SPX, the late day Yen strength also weighed on the SPX it seems.

Longer term, to the left a normal carry correlation, to the right, any consolidation or threat of the Yen moving higher upsets the market as volatility/chop pick up.

The EUR/USD not quite making $1.30, better luck tomorrow Mr. Draghi or should I say Merkel?

The EUR/USD trendline break, the question is how long can the ECB support the Euro with a rising $USD?

As to several assets that seemed to show things weren't as hunky-dory as they seemed...

Yields didn't follow the SPX at all, so we seemingly still have an issue with major 10-year and other bond holders looking for a safe haven asset and not willing to give it up as I wrote about yesterday.

GLD ended up with a much nicer positive divergence by EOD than I expected and I posted on it earlier expecting some positive movement, the 1 min

The 3 min with a big divergence

And the 5 min, all went strongly leading toward the EOD, another flight to safety and...

Gold was able to manage this as the $USD was higher, not typical.

The flight to safety trade in Treasuries has been picking up steam as well, the 10 min TLT chart.

The 30 min chart leading at a new high

And you already saw the ViX futures in the last post, it seems the ViX was bid today as traders were seeking out protection, take a look at the relative levels of the SPX vs the VIX and specifically today.

As for breadth indications, all went downhill, here are a couple of note.

% of all NYSE stocks trading 2 standard deviations above their 40-day moving averages, this should be rising, not falling and the last several days have seen the percentage fall from 29% to 17%!

% of all NYSE stocks trading above their 40-day moving averages, from topping at 85%, this too should also rise or at least maintain, we're now falling under 60%, 25 percentage points.

The 4 wek New High/New Low Ratio has taken a very sharp turn to the downside in to higher prices.

And the McClellan Oscillator is not only long term divergent and crossing below zero, but has a pretty sharp divergence locally.

Finally as a sort of measure of breadth, the Dominant Price Volume Relationship which isn't as useful tonight because volume will be down no matter what after Quadruple Witching, but the extent of the component stocks down today as risk assets were so tightly correlated shows there was more running toward safety.

All 4 major averages are Price Down/Volume Down, but look at the components and how many were down, this would certainly have been a dominant P/V signal had it not been for op-ex Friday.

As far as Futures go tonight, there's a recent slight uptick swing, I'm not very interested in it at this point, but will be watching to see if it gets more interesting or if signals get more interesting.

In the VERY immediate future, see my post earlier today on Gold/GLD, I think the April Calls are going to see a nice momentum move, I don't care if GLD slowly drifts higher until April, I want to close that call position in to momentum and then look at a new position, I think that is going to be the next trade to need management.

Tomorrow should be interesting, Cyprus vs. Germany vs. Russia.

No comments:

Post a Comment