I think it was last week, I opened UVXY long as a trading position, there's also a VXX long as a longer term position.

I'll be looking to add to UVXY as a short term trading position on a move in volatility.

Volatility looks to be confirming what I just showed you in the Futures post, "Game Plan For Today".

I'm trying to build the case a little right now because I think things are going to start moving so quickly that I won't have time to post the charts later, this helps build the case and gives me confidence the probabilities are lining up on the right side.

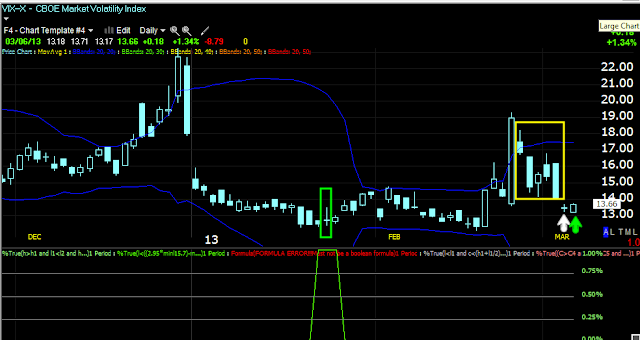

First the VIX...

Since my custom buy/sell indicator gave a buy signal in the VIX (green) it has performed pretty well, after the big move up on Feb. 25th, the next 6 days all stayed within a Rising 3 Methods bullish continuation pattern, yesterday's VIX broke below that, but did form a bullish morning star Doji, so far today with the open below yesterday's close and so long as we have a VIX close above yesterday's VIX close, we have a bullish reversal signal for the VIX and confirmation of that signal, which is bad for the market.

As for the VIX futures (ETFs-VXX, UVXY and XIV), they too are all moving in the right direction and building on the divergences.

VXX-VIX short term Futures...

Intraday the 1 min VXX which trades opposite the market has a small intraday min negative divergence right now, this fits perfectly with the ES/NQ 1 min positive divergence, so there's confirmation there.

More importantly the 3 min positive divergence in the VXX yesterday has migrated to longer charts and is now leading positive on the 5 min as well as some longer timeframes, we also have the flat range as well.

The leveraged version of VXX, UVXY also has a current 1 min intraday negative divergence which confirms the ES and NQ futures as well as the VXX above.

More importantly though is the 3 min leading positive divergence from yesterday migrating to longer timeframes like this 5 min leading positive divergence and within a flat range.

The 10 min chart is seeing migration as well and leading positive, this is what we want to see in a growing divergence.

XIV is the inverse of the VIX, VXX and UVXY so it should have exactly the opposite signals for confirmation.

1 min intraday it is positive so that is confirmation of all the charts in the last 2 posts.

This suggests we will get our chance to short strength and buy weakness.

However where it really counts, the 5 min chart is now leading negative, migrating from the 3 min chart from yesterday.

This 60 min leading negative chart is exactly why I want a longer term VXX long position open, I'd rather use the leveraged UVXY for short term trades, but I like VXX for a longer term position to take advantage of a spike in volatility on a market reversal.

So I'll likely be looking to add a little to UVXY long as a trading position and VXX long as a slightly longer position trade.

The most important thing about this post is that it confirms everything we see in the futures and maret averages thus far

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment