We have what appears will be a mixed open with the SPX, Dow and NDX all opening near yesterday's close, while the R2K looks set to gap down a bit.

Here are this morning's futures...

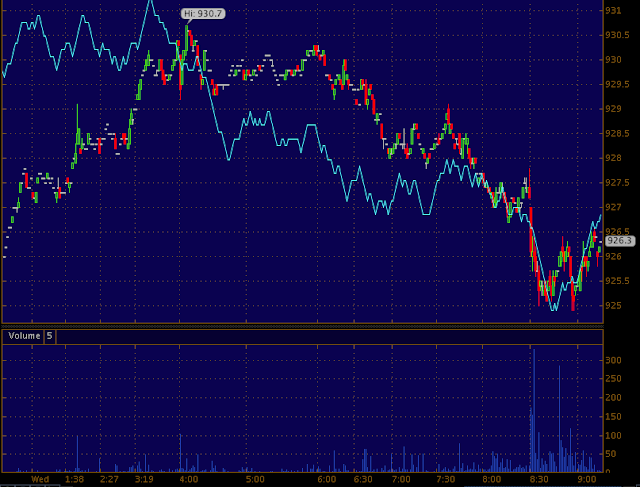

ES/SPX Futures- after surging to new highs for the week overnight, weakness came in just after the European open on some bad German Business Confidence report, ES is in line right now.

NQ/NASDAQ futures also surged to a new high on the week overnight and saw a negative divergence at the same time as ES above, just after the European open, however there is a fairly substantial positive divergence going in to the US open.

TF/Russell 2000 Futures also surged to a new high for the week overnight and declined at the same time, 4 a.m. EDT, R2K futures are currently in line with the 3c/Price trend.

The $USD looks set to weaken pretty significantly at some point today, the intraday chart isn't quite there, but the 5 min shows substantial weakness building in, this is a market positive. The Euro as of now has no major divergences and looks pretty flat, I imagine the EUR/USD would rise just on $USD weakness, again market positive. After seeing some initial overnight weakness, perhaps on news of the bird flu spreading from China to Taiwan, it recovered well and has a leading positive divergence, generally market positive, depending on the Yen. The Yen still looks very confused, I wouldn't be surprised to see early weakness (market positive).

As for the pairs, the EUR/USD (as suspected) looks like it will see some upside, the EUR/JPY, USD/JPY and AUD/JPY have no significant signals right now, overall, somewhat market supportive.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment