First I want to say I bought a Samsung Galaxy S4 This weekend after having been an I-Phone person forever, I don't know what AAPL will do next, but I couldn't sign a 2-year contract for an IP5 when the S4 was already blowing it out of the water. This is what AAPL missed on the IP5, my exact words were, "This is the first I-Phone that isn't revolutionary, but evolutionary", the S4 is revolutionary, maybe in some gimmicky ways, but I find them useful, I wish I had some on my computer.

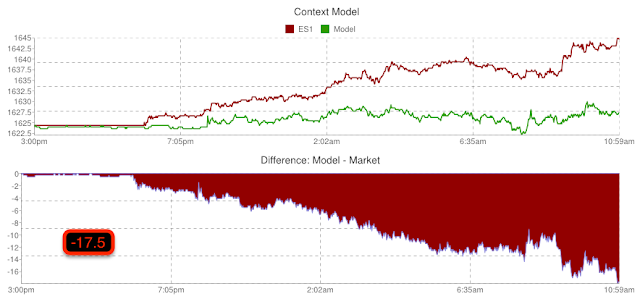

OK, the market. First let me say the SPY Arbitrage is non-existient this morning, but CONTEXT for ES (SPX futures) looks REALLY bad. I'm not sure if this is something we should expect, but I do want to see how the market reacts to a pullback and we have plenty of time for that to happen today, this is why I have been closing down some nicely profitable positions as they can be added back at a lower level.

The CONTEXT ES model is 17.5 points lower than ES, suggesting ES is quite over-valued at the time.

ES 1 min isn't horrible, but volume has fallen off badly and there's a negative in place.

The same with NDX futures.

Oddly though, I don't see too much wrong with the USD/JPY or the $USD and Yen that would suggest that's where potential pullback momentum is coming from. I guess we'll see, I still have some open calls like XLF, and others, but I wanted to take those gains and see if we can not only get good information about the near term, but also set up new positions.

The SPY 2 min, as mentioned earlier, is just not confirming as it should this early.

The IWM 3 min was very positive Friday afternoon, thus the gap up, but it hasn't added anything to that chart today, 3C was already up there Friday, again, not as strong in the near term as I'd like to see.

1 min VXX suggests a move higher, which sends the market lower.

However at 5 min where it's important beyond an intraday wiggle, VXX ix negative which is in line with a nice, durable short squeeze this week.

TLT is also positive suggesting the same as VXX, yet again...

The 3 min is negative suggesting the same as VXX 5 min above.

And finally...

HYG 1 min has a pretty sharp negative divergence, if HYG comes down and TLT and VXX all move up intraday, that's a solid arbitrage move and the SPX/market pulls back, perhaps a nasty pullback from the looks of CONTEXT, but all that really matters is the underlying action in to any such pullback.

If it's positive, then we can start setting up new positions in FSLR, IWM, XLK, etc.

Once again, the momentum on HYG's 5 min chart is also indicative of a stronger, bigger move coming, this I believe with about 95% certainty is the short squeeze this week I mentioned last week, last week I didn't think 2 days was enough time to keep the psychological pressure on before a weekend and likely pullback in global markets based on 2-days of US market strength, thus Friday was the "Nothing" day I expected.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment