In other words, there has to be some really strong signals that are unquestionable or as close as we can get to that place.

So far as expected yesterday and last night, none of the potential currency engines are working to support the market which leaves the SPY arbitrage which is not in effect yet, but moves in VIX futures seem to be an attempt to establish it again today since carry pairs aren't going to do the work.

There are a few areas where there are some interesting charts that are very close to trades, Financials (short) is one, I'll be featuring them shortly.

We still have plenty of time today to see where things are going and I wouldn't expect to get anything very useful from a.m. trade.

I'm going to try to give an overview rather than a long post with dozens of charts.

None of the carry crosses (currencies) are in position to help the market as expected yesterday leaving the SPY Arb as the next choice in short term market manipulation.

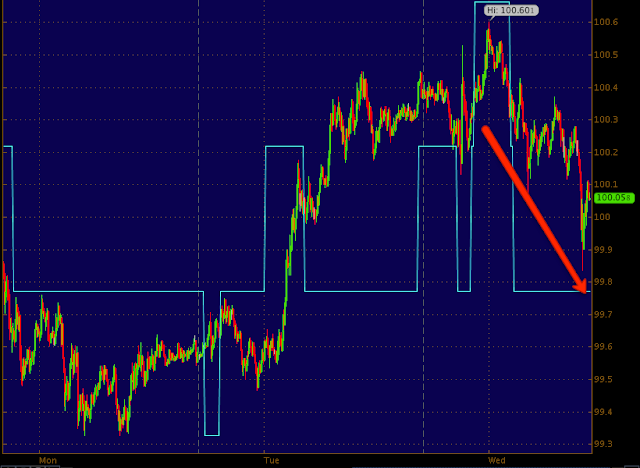

AUD/JPY 5 min

E?UR/JPY, the former engine of early this week now failing

USD/JPY not helpful either.

As for the market averages thus far, they are not all confirming each other in all of the timeframes, but the general tone is confirmed throughout them.

However, that move appears to have been sold in to which is exactly what we expected from the "expected" strong trend to the upside which is what we expected to occur after a brief pullback to make the base stronger to support the upside trend.

So we may in fact have a weaker upside move because the base wasn't re-inforced and we seem to have early distribution, essentially in to any reasonable price strength, this changes the out look of this section of the expected moves, it becomes more volatile and less predictable with most likely, a shorter lifespan up here.

SPY 10-min shows again where the market was ready to pullback to the lower end of the range to accumulate and create a stronger base for the market to rally from, we lost that move early this week on John Kerry's comments about dis-armerment that the Russians, Syrians and Chinese jumped on immediately, "YES, BRILLIANT IDEA! WE BACK IT 100%"

I still can't figure out if Kerry made a mistake that created this situation in talking off the cuff or if this was the administration's way of avoiding a congressional vote that they were destined to lose, likely even among their own party?

DIA 5 min showing a sharp leading negative divergence in to higher prices, I think there's little doubt of what is happening, it is what we expected, the doubt comes in to play as to how this wraps up.

IWM 5 min

QQQ 30 min, this is now getting to be a very serious negative signal, this is the kind of longer term negative signal that I'd like to see to have more certainty, but when a cycle is screwed up and you have a fairly large accumulation base, the shares (long) from the base need to be distributed and the main reason they were bought was to send the market higher to sell short in to so not only do the initial shares have to be sold, but the reason for buying them, selling short in to higher prices has to occur as well, I just don't know if the market has the support mechanism to hold prices in place in this area for long.

No comments:

Post a Comment