Well this is at least one to put on the radar and consider.

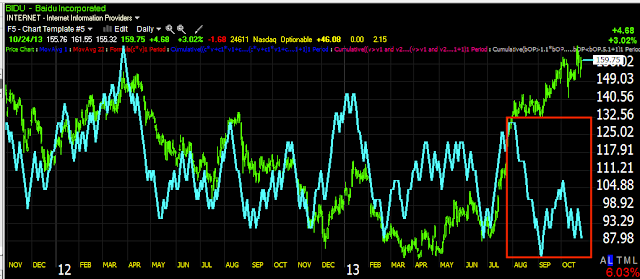

A Quick look back, BIDU #1 Primary uptrend, #2 a large triangle, after an uptrend these almost always tend to be a top and halt the trend. #3 a breakout from the triangle, but being we know these are not bullish consolidations (way too big) we suspected a head fake, 3C confirmed and at a breakout from a small triangle at #4 we shorted BIDU just about 1% from the top, we covered at #5 for nearly a 30% profit in about 3 months with no leverage. #6 is a well formed Bullish bull-flag that absolutely fell to pieces.

3C is showing something interesting recently, a nice bottom with accumulation, but a sudden distribution signal on a daily chart, almost as if the move were cut short, in any case a distribution signal on a daily chart is a big deal.

Money Stream shows a long term leading negative divegrence as BIDU makes a higher high or a large double top, this is a perfect example of one of the hundreds of stocks that were so close to a very natural head fake area, that I suspected we'd have this rally off the 10/9 lows before we had any accumulation signals for it.

This is the set up.

The trend version of 3C shows the same thing and MS and 3C have no similarities in construction.

Here's a shorter term 1 min chart from accumulation and a nice reversal process to distribution, I almost put out a short position on this when I saw this, but decided I was a little too over eager and held back.

The migration is evident today as well in longer charts (2 min)

The 5 min is where it's holding and there was a hammer candle right at that low, so I think it's good I held back as I don't think this is done flopping around, but I do think since it has already made the new high, which is what I was looking for and anticipating as I said I had hundreds of stocks in this position that just needed a little boost that the last bounce off the 10/9 lows gave us, I think BIDU belongs near the top of the watchlist. I'd call BIDU a strategic short in need of a tactical entry.

You may want to run it past some of your charts.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment