Picking up where I left off with the last post...

Well here's a lever I haven't seen in a while, it's funny how these things move in phases, today it was using the most heavily weighted stocks in an index to push it higher. As few other levers are working or working as well as they use to, today's very light volume was a perfect day to just knock out the ask stack on heavily weighted stocks.

I came up with a few examples without spending all night on it. Take the Dow-30 which closed up +0.15% today, really that's negligible, but it would have been worse if it were not for taking out the ask stack. Only 8 of 30 stocks closed greater that +.50%

MMM of the Dow closed second from the top at +1.03% however as far as weight goes, MMM is the 5th heaviest weighted stock in the Dow at 5.28%, this is about the same weight as T, PFE, GE, INTC and CSCO combined.

IBM closed 3rd from the top at +0.95%, IBM's weight is a hefty 7.08% of the Dow 30, this is about the same as T, PFE, GE, INTC, CSCO and add MSFT and IBM still holds more weight as the other 6 Dow components combined are worth a total of 6.77% of the Dow vs IBM's 7.08%, so with those 2 stocks alone closing up near 1%, the Dow was saved from a red close.

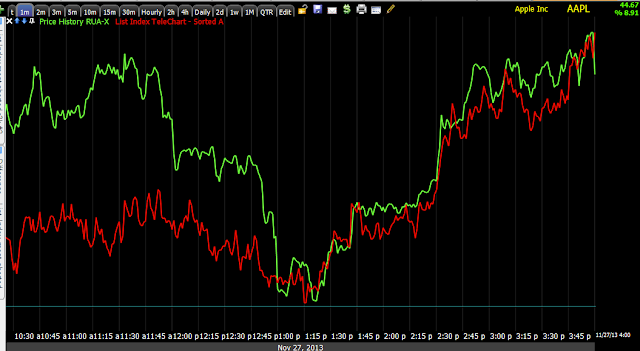

Taking a quick look at the SP-500 which use to use a market capitalization method to weight the index, but now uses the more specific "Float" Market Cap of all shares publicly available to be traded). Not surprisingly, the most weighted stock in the SPX is AAPL which closed up +2.34% today.

I took the top 10 most heavily weighted SPX stocks and combined their closing percentage and divided by 10, I came out with +.25% while the SPX closed at +.24%, that's pretty amazing. AAPL must really carry some weight because only 4 of the top 10 closed green and AAPL was the biggest gainer.

NASDAQ has a proprietary weighting system and you can only find out the current weighting with a $10,000 a year NASDAQ subscription, but from the post we know that AAPL has been around 20% of the weight alone, I added up the bottom 50 of the NASDAQ 100 and their combined weight was about the same as AAPL's, so with AAPL up over 2% today, you can see how the NASDAQ and SPX closed green when no other levers were working and TICK wasn't indicating any great number of stocks moving.

AAPL got some intraday 3C help, but it was thin, it didn't need to be much more with volume so light and there's still problems so I'm fine with a short there.

Intraday EOD help

Still at the next timeframe, 2 mins, still trouble so intraday today was weak (3C signal).

The cheaper stocks and the most shorted also improved in the afternoon,

The R3K MSI improved in the afternoon.

As has been apparent, distribution in HYG was going to knock that lever out of the game and sure enough...

HYG (green) vs the QQQ today and falling in to the close, but this shouldn't have been a surprise as we've been covering trouble there...

5 min leading negative divergence/distribution in HYG.

It looks like Credit sold off because of the run up.

High Yield put in another day of losses...

HY credit

No matter what the market is doing, protection is bid so someone is a bit worried, checkout spot VIX today.

Spot vix vs SPY (green)

We also got news that NYSE Margin Debt has hit another all-time high. Investor "Net Worth" defined as Total free credit in a margin account less total margin debt is at all-time lows.

Relative to the economy, margin debt has only been higher at the peak of 2000 and 2007.

Deutsche Bank wrote about this in an article called, "Red Flag!" and compared their findings to those at 2000 and 2007 and said they were indistinguishable.

The dominant Price/Volume relationship was close up/ volume down which is the most bearish of the 4 possibilities, but considering the holiday week, we may give that one a pass.

Interestingly though, futures have something going on....

The carry pair EUR/JPY looks to have taken a pretty sizable hit since about 6 p.m. EDT.

I've been talking about some accumulation in the Yen, but...?

The Yen has moved up on a positive divegrence, although the carry pairs drop seems larger. We'll see what happens, I'll check in on this later, but very interesting considering the market couldn't put anything together without the NY F_E_Ds open markets desk knocking out AAPL's offer stack.

So far there hasn't been any reaction in Index futures, but NQ doesn't look too hot.

I suppose the divergence makes sense as today was almost exactly like yesterday, NASDAQ and R2K up +.72% and +.60% respectively and SPX and DOW up +0.25% and 0.15% respectively.

I don't see any other immediate reactions, but I'll definitely be taking a look later tonight.

I wish everyone a Happy Thanksgiving, US markets are closed tomorrow and a half day Friday.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment