If I ONLY looked at the NYSE TICK chart for today, my guess would be that the daily candle would be a stalemate or a Doji which is an opening and current/closing price at almost the exact same level, it's an indecision candle and while that may not sound bearish, when you have a day like Friday, you want to see follow through not indecision as indecision opens the door to reversals, this Evening Start Dojis, Harami's, etc. all being reversal patterns as well as the bullish versions too.

This is the NYSE TICK index, all NYSE advancing issue less declining issues. Readings that range in the +/- 750 area are very neutral, so looking at this alone, I'd guess there's no trend other than lateral as TICK itself shows no trend other than lateral.

A look at the SPY...

A Textbook, perfectly formed Doji, actually an "Evening Doji Star", which is the second part of a 3-candle downside reversal pattern.

The reason why?

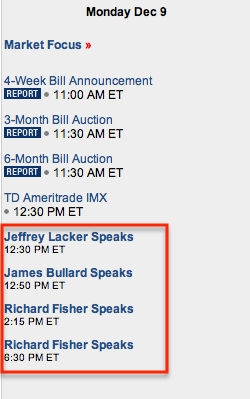

Next Tuesday and Wednesday the F_O_M_C meets with a policy decision coming Wednesday December 18th at 2 p.m., that means today is the last day before the 1 week "Blackout " period for F_E_D speakers, thus today we have 3 different F_E_D speakers at 4 events as the market has a last chance to try to divine what the F_O_M_C might do through their speaches.

Here's today's schedule for F_E_D speakers.

Considering this is the scenario, it's not surprising no one is making any big moves before they hear what is said.

Richmond F_E_D President Lacker already spoke and from what I can see, he didn't have anything surprising to say and there has been no market reaction. I think one of the highlights of his speech was, "There's nothing the F_E_D can do to boost growth".

From what I've seen of St. Louis F_E_D President, James Bullard, his most exciting comments (also with little to no market reaction) have been, "A small taper of QE in December might recognize the improvement in the Labor market, while giving the F_E_D an opportunity to monitor inflation in early 2014"

Other speakers have not started yet,

However I think there's something to Bullard's statement that sums up the F_E_D's scenario uncomfortably between a rock and a hard place.

Recall the Taper talk back in May/June and the Bond market lifted yields 1% on the benchmark, it hurt housing and various other industries that are interest rate sensitive, THEN THE F_E_D DID AN ABOUT FACE AND COMPLETELY SHUT-UP RE: QE TAPER.

Since then, Bernanke himself has gone through extraordinary pains to pullback original F_E_D guidance that an interest rate hike would follow about 6 months after QE ends, this is what sent the Yields spiking when hearing that half of the participants wanted to end QE3 by the end of 2013, several wanted to start at that meeting. The bond market didn't like that and they (not the F_E_D) took rates up 100 basis points and hurt housing and other areas.

You may recall I kept asking, "What is the F_E_D so Afraid Of?" That's the answer, they are afraid the bond vigilantes will do the same on a QE taper thinking a rate hike is soon to follow which they are more concerned about that tapering itself.

Bullard's comments hint at a small taper in December that allows the F_E_D to see how the market responds, but not with regard to inflation, with regard to yields. It makes perfect sense.

In any case, this explains (for me) why the market is in a holding pattern, I still haven't forgotten about Friday's overwhelming Dominant Price/Volume relationship which would normally see the next day (today) close down.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment