We have had our eye on VIX since November 10th's custom buy/sell indicator's buy signal and subsequent Bollinger Band pinch which indicated a highly directional move was near to beginning, thus a market decline as well. With last week's worst weekly performance in the Dow in 3 years and the SPX's worst weekly performance in 2.5 years, there was certainly good reasons for the signals we were seeing indicating a higher VIX and lower market so try to think of the current update in the same manner.

I expect the IWM/Russell 2000's 6 week trading range that has already been broken to the downside to gain market momentum on an upside reversal as new shorts are squeezed, thus creating the head fake or second part of a Crazy Ivan shakeout, not only offering excellent short side entries with less risk, but one of the best timing indicators we have for a stage 4 reversal/decline and I know we already saw that start last week, but without a head fake move in the IWM with such a clear range, I honestly don't think we've seen the actual stage 4 decline reversal to the downside yet, meaning the resulting downside should be quite a bit stronger than last week's and last much longer, erasing all of the October gains and moving to a new lower low for the year. With HYG and TLT in place, VIX is the 3rd of 4 major levers (the USD/JPY being the last) used to ramp the market as it doesn't have the strength to do it on its own represented by a 6 week range in the IWM, unable to break out of it.

It is in this light that I present the VIX update and to be considered in such context.

First odd behavior in the VIX itself.

Yesterday I pointed out the strange intraday volatility in the VIX one day after a Star closing candle with long legs appeared in spot VIX. There were several options exchanges broken yesterday so one could have said such volatility intraday was a result of these options exchanges down, but the activity continues today with no option exchanges off line so far as I know.

I don't claim to know what this is beyond volatility and a change of character, but I don't believe that it should be overlooked, I think it will lead to a change in trend, even if only a brief one.

The closing candle on Friday was up, but a Long-legged Star, which is a cause for momentum concern, it's basically indecision and the next day (yesterday ) we have a lower VIX close despite all of the averages in the red, all 9 S&P sectors in the red and most of the Morningstar groups in the red as posted in last night's Daily Wrap, a deeply oversold short term condition in the market averages that would normally see the next day (today) close green.

Today's candlestick (daily) in spot VIX above is doing little to inspire faith in a run higher in the fear index which has inverse market implications.

HOWEVER I DO NOT BELIEVE THE VIX'S UPTREND IS DONE, I DO THINK IT WILL TAKE A BREATHER.

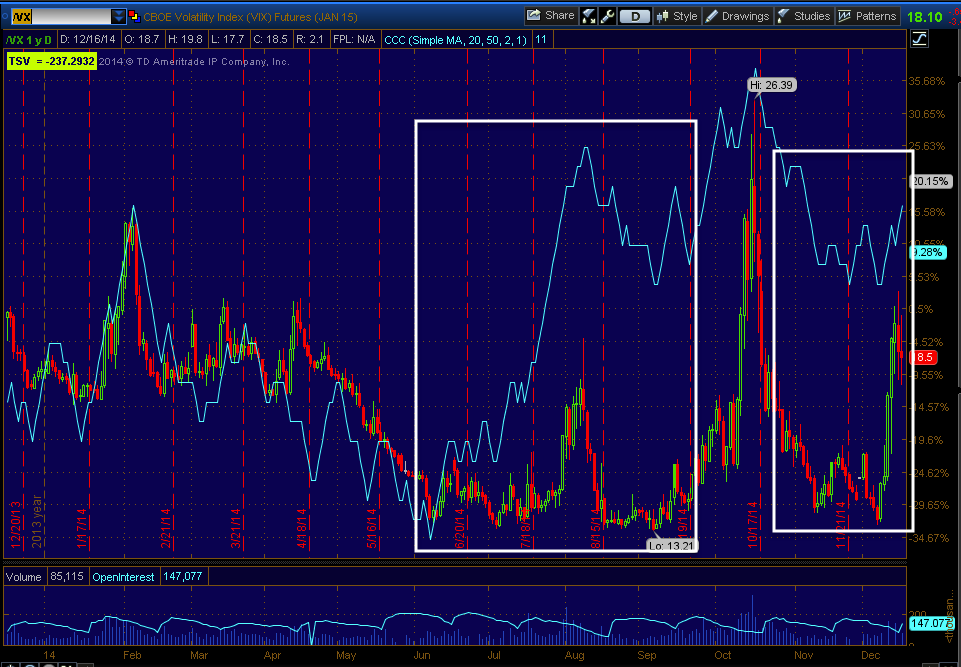

Turning to VIX Futures ($VX)

The daily 3C VIX chart shows two massive positive divergences, the first already completed a run higher in to the market's October lows, the second is leading positive and has started a move higher.

This is the big picture and the resolution of highest probability despite short term market action in the coming days, VIX should head higher shortly after some weakness and the market much lower after some strength which I believe specifically will see the IWM above $118 (the top of its 6 week range).

The 60 min VIX futures has shown a positive divegrence and run up, but now shows a near term negative divegrence in to it's highs.

The 30 min chart gives even more detail of the area seen above. Thus I do believe VIX comes down, just as I believe the market bounces up around the IWM's range.

Longer term, VXX Short term VIX futures confirms the highest probability resolution in showing a huge leading positive divegrence, thus I expect a head fake move in the market, some near term VIX downside and it all to be followed with VIX moving to a new high and the market to a new low for the year.

This is the 3rd of the 4 major levers or usual suspects.

No comments:

Post a Comment