So we have a decent gap on a Greek deal that really isn't anything more than an understanding of what needs to be done in order to restart "Formal Negotiations" which in large part means here really isn't any deal on the table, no cash disbursements, there's just the daunting task of trying to get this "worse" than ever proposal (worse than the last memorandum of understanding MAU which the Greeks railed against) through multiple parliaments including the Greek parliament who may be wondering,

"If we were going to drop our pants and give in, why didn't we do it a month ago before billions in deposits left our banks, before our country was thrust back in to recession and while the terms for a bailout were BAD, BUT MUCH BETTER THAN THE NEW TERMS?"

That's a pretty hard question to answer and I'll say the same thing I said when Syriza came to power and failed in their first negotiation, only walking away with a name change of "Troika" to "Creditors" or other similar meaningless concessions. How could they possibly have gone up against the ECB, the IMF and the EU, which means GERMA?NY specifically without a Plan B, without SOME leverage? The most leverage they brought to bear was the referendum and that as you can see did nothing other than expose Europe as being a dictatorial monetary union that's not much different than the Soviet Union, only this time their weapon is Euros. I just don't get how Syria could be that dumb not to have a plan "B" when playing a dangerous game of chicken and now they have something MUCH more punitive than 3 weeks ago which really is nothing more than a warning to Spain (especially), Italy and even France, that Germany is running the show and has effectively taken over the European continent without a shot fired.

So, do these parliaments, especially the Greek, pass the understanding so formal negotiations can begin? Big wild card and multiple nations have to do the same otherwise, NO SOUP FOR YOU!

As for the charts, do you realize that from Friday July 2nd to Friday July 10th (last Friday), despite over 2500 points of Dow movement, the SPX moved only -0.01% ?!?!?

Yep, that's it until today.

To the charts...

The Dow-30 daily chart with today's break above last week's resistance, this is the bounce we expected so far.

The daily SP-500 with a break to the 100-day moving average in light blue, but meeting resistance there around $2095. Note that the pattern of lower highs and lower lows on a primary trend chart of the SPX is still in effect ever since the head fake move we forecast over a month in advance at the May false/failed breakout.

Interestingly as the SPX is having its BEST 3-day move since December (about the same time we opened the VXX puts), meanwhile in FX land things are taking a different view of events in Greece.

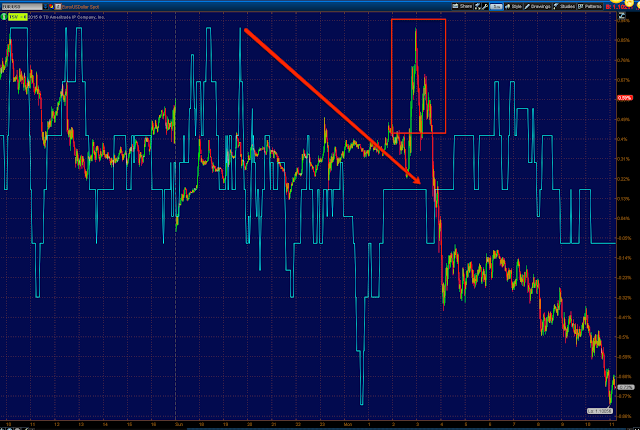

The 5 min EUR/USD with a negative divergence at highs and another negative divergence at the Greek deal news on a parabolic spike up.

Very short term intraday 1 min this is what the EUR/USD looks like, I'll cover this separately as I need to go through all of the $USDX and Euro futures to figure out what's going on there, but you wouldn't typically think the EUR/USD would be down while the SPX is having its best 3-day performance since late 2014.

REMEMBER WHAT I'VE SAID ABOUT THE PURPOSE OF THESE BOUNCES, IT'S NOT TO WORK OFF AN OVERSOLD CONDITION, IT'S NOT EVEN A RELIEF RALLY, IT'S TO SELL IN TO AND TO DO THAT, THE MOVE MUST LOOK CONVINCING, thus the best 3-day performance TYD.

Intraday in Index futures, while ES and NQ are pretty close to confirming intraday, the Russell 2000 futures aren't

TF 1 min intraday not confirming.

However the ES 5 min chart and others, still haven't put in that positive divergence that I would consider necessary to feel good about holding a larger bounce position (beyond speculative size) overnight.

The last capture of the NYSE TICK looked like this, other than an opening near +1400 print, it has been trending down in a mostly flat price environment intraday (beyond the opening gap up).

The Custom TICK was reflecting the same thing until the last 40 minutes or so with some intraday improvement in breadth.

As for the averages...

The 1 min SPY intraday has failed to confirm the upside which it could have done in the first 15 minutes of trade.

The 2 min SPY chart hasn't confirmed either which is to be expected with the 1 min not confirming, but additionally there's some intraday deterioration here as well.

This can also be seen migrating to the SPY 3 min chart so while the negative tone is strengthening, it's still not screaming and a SHORT THIS IMMEDIATELY signal, but it could lead to something such as a pullback or perhaps the start of the end of the bounce, we have to keep monitoring it, but I wouldn't be chasing price for sure.

The 5 min SPY chart , as you'd expect, has not confirmed the gap up today .

The 10 min SPY bounce chart/positive divergence is still in effect, it would be when this chart deteriorates that we'd be closer to the SHORT THIS IMMEDIATELY.

As you can see the QQQ 1 min intraday has not confirmed the gap up and is flat intraday beyond the a.m. gap up. This is the same situation in the 2-5 min. timeframes just like SPY above, no confirmation.

The IWM intraday charts like 1 min DID confirm, but have since started turning negative. This capture is a bit older from earlier this morning than I'd like, but there has been additional deterioration since.

It's also migrating/strengthening as it travels through longer timeframes such as the IWM 2 min

Only the IWM 5 min is close to confirmation from earlier strength last week, but I suspect the 1-3 min deterioration will migrate to this chart next.

THUS, it made little sense to hold the VXX put position beyond this morning with flat trade since.

The IWM 15 min positive divergence/bounce chart is still in place so we could see continued consolidation from here, perhaps a pullback, but for now, I don't see any edge in adding any new positions long or short here, not until we have a better idea of which way this is going which could be a pullback with additional upside as the 15 min chart above could certainly support it or perhaps as I said earlier, this is the beginning of the end of this bounce as sellers are out in to any higher prices.

Since we first said there would be a bounce, it was called a RISK OFF bounce rather than risk on, meaning it would be sold in to in order to reduce long risk (and/or shorted in to).

Remember the first lever the market pulls when it needs upside support/manipulation? High Yield Corp. Credit? Well this is the HYG 15 min chart, again this is in line with the IWM bounce chart above and looks like it could very well support more upside as initially envisioned.

However, like every thing else this morning, it too is seeing deterioration intraday.

This is a capture from earlier this morning of the intraday 1 min HYG chart seeing distribution intraday, selling in to higher prices (an /or shorting).

Since the last capture, this is the current version of the same chart.

HYG 1 min seeing an even larger leading negative divergence.

So we'll have to keep an eye on these charts and TICK chart which should give early warning of a pullback. I doubt the move is over yet, but whether it consolidates here, maybe gains more upside in to heavier selling and gets us closer to the downside pivot or pulls back and puts together a bit more support and runs through the rest of the week as originally envisioned (meaning run through the week including not only upside, but the topping/reversal process before a downside pivot).

I'll have more on HYG, VXX as well as other assets that will tell us more about the market near term, longer term nothing has changed, the bias is CLEARLY to the downside.

No comments:

Post a Comment