There's clearly a short squeeze above the SPX's 100-day moving average, however there also appears to be another event in the making, the opposite of a downside flameout or capitulation and that would be the same concept in reverse, an intraday churning event.

This is where it looks most obvious...

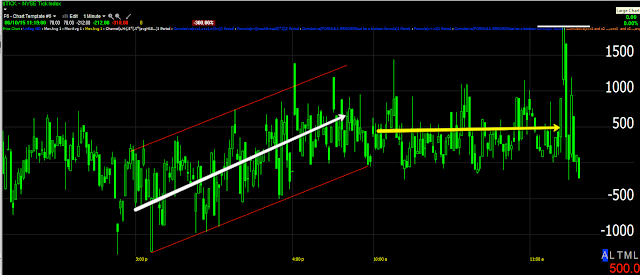

The intraday NYSE TICK chart first breaking its uptrend channel and like a final burst or what some might think of as a blow-off, a TICK extreme of well over +1500 and TICK falls apart to the downside just after.

We look for large volume and in this case a bearish looking candle with these events, like an intraday flameout to the downside.

SPY with huge volume on a 10 min candle with a large upper wick (higher prices being rejected). On a daily chart we'd almost certainly consider this a churning event. The other averages are displaying the same behavior as well.

I initially doubt that this is the move we were looking for and it's winding down as there was/is more support for the "W"base proposition from yesterday so I'm not going to rush to a conclusion, but let the charts continue to tell us.

So far...

The SPY intraday 1m is still not confirming and in a negative divgerence, although not a terribly ugly one right now.

This has migrated already to the next timeframe at 2 min

And the overall look of the price pattern may look familiar...

The Q's intraday are also not confirming and negative in similar manner as the SPY.

They are also seeing migration of the divergence to a stronger timeframe at 3 min

And IWM shows the same, negative intraday with no confirmation...

And also migrating to a longer timeframe.

This is definitely an odd bit of price action this morning, however, it does look like a churning event just occurred.

I' m going to gather as much evidence as I can to try to determine whether 1) it is a true churning event and intraday top, 2) if there's a chance of a "W" base still forming or 3) if this was the extent of the bounce/head fake above the 100-day as the base it launched from was an unstable "V" base.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment