Since there's nothing we can really do to divine what the F_O_M_C policy statement is and more so, what Yellen says at her press conference after which can be just as moving if not more, I plan on waiting for the typical, likely knee jerk move and then looking at the knee jerk move and seeing if there are opportunities there, that's where I want to trade as the uncontrollable aspect will have past, price should move and we should be able to see if there's a strong trade set up.

As for the market, it got more and more ugly as the day went on, it could simply be fear in front of the F_E_D, or it may be the set up of a knee jerk reaction, while they sound random "Knee jerk", they are often set in advance as price movement is the fastest reaction to the F_O_M_C so that will initially define the perception long before anyone has a chance to actually read what the F_O_M_C said.

This should give you a rough idea, although there are too many assets, too many timeframes, too many charts moving too fast to cover this in depth, but I think this is a good basic example and shows the wisdom in waiting as outlined above.

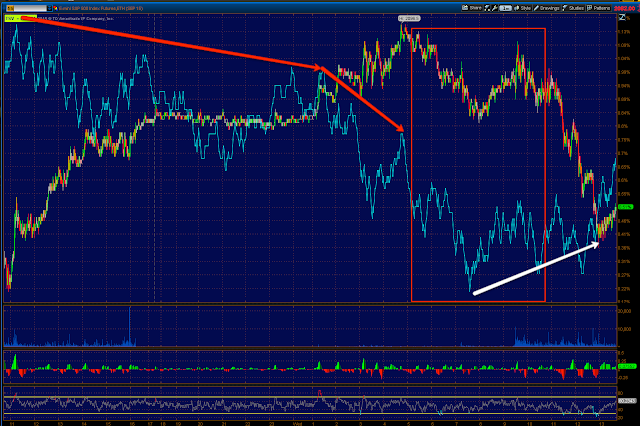

First the SPY and ES which was showing negative divergences as was ES overnight in the A.M. Update with a 10 min negative and a lot of damage. I believe this is the true underlying trend, but that doesn't matter if they you can't hold the trade and they can shake you out.

ES

Es 10 / 15 min leading negative , this makes sense with rice action today thus far, I believe ultimately it will make sense with price action after the F_O_M_C typical games (we see them almost all of the time, the last meeting was much more subdued though).

Es 10 min chart leading negative off the 150 ma bounce.

Intraday ES has been negative since last night and it has moved in accordance with the divergence, giving up considerable ground since the overnight session, however this is my point, see that small positive divergence to the far right? That may be nothing or irt may be the set up of a knee jerk reaction, remember they are almost always wrong and almost always retraced within several days, but when you first see them, they don't look or feel wrong and that's their reason for existing, knocking you out of the trade.

SPY

SPY 3 min and the two bounces off the 150 ma (white) with two negative divergences off those bounces, remember yesterday's charts and internals, horrible for such a move.

SPY 5 min also leading negative and price has moved as would be expected for that signal, the two charts above are the stronger signals, but the more immediate one is the chart below.

SPY 1 min negative in to today, confirmation n the downside and that same little 1 min positive to the far right.

VXX

The 5 min chart leading positive in a huge way, but I didn't put out an additional trade/buy idea.

The 10 min looking good here too, but just like ES, SPY and a num,her of other assets...

The weak, but more immediate 1 min intraday VXX chart event negative just a bit ago, which is why I would't put out additional buys yet.

Everyone is going to be reacting emotionally and moving al around, chasing the market if history is any judge. I think we are best served to stay patient, let the uncontrollable part we have no idea-the F_O_M_C- pass and the one jerk start if it will be there. Then lets see what's under the hood and let the trade come to us rather than chasing emotional games, again if history is any judge.

Unless we get a big fat rate hike surprise...

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment