It's pretty clear that the accumulation/distribution cycle is still in play and full control as news just bounces off the market. The locals have invested in a bounce and a bounce is what they are going to make sure they get, which has already been assured.

However, as you may have seen, it doesn't look like much more then a bounce and we should see a renewed leg down. If the next leg down can close below $125 and move a bit further south, trading will get a lot easier as we will have moved far enough away from the top that manipulating these head fakes into support and resistance of the top will become a much more expensive and risky prospect for the HFTs and other locals. At that point, we'll have entered a fairly smooth sailing stage 4 decline.We'll still have our bounces and such, we may even get a decent bounce off the $120 level as the 200 day moving average should be in the area around that time. Technical traders will make that a self-fullfilling event.

When the 200-day average is broken, support will be difficult to come across. There are a few zones that may still act as support, but many trading programs will go completely bearish upon a break of the 200 day average.

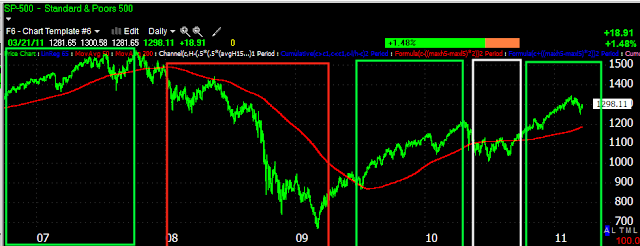

In fact, it's useful if you don't want to get into the intricacies of Dow Theory, to use moving averages to define the trend objectively. As they say, "Trade with the trend". First you need to know what type of trader you are to determine which timeframes will be most important to you. Moving averages are a good way to objectively know where you are in a market's life cycle or the 4 stages that I've talked about (Accumulation, mark-up, distribution, decline) and the neat thing is, they are fractal so whether you are an investor or a day trader, the same 4 trends in the series play out over and over again. To know where you are going, you need to know where you are.

So I'll suggest keeping track of at least the 3 major trends: Primary, Intermediate and Short-Term. The moving averages you'll want to use respectively are (all simple averages) the 200 day, the 50-day and the 10-day. Identifying the trend is as easy as that. Understanding when the trend is changing is where the science and art come into play, but in general, you want to be on the same side as the market's trend or a particular sector or equity's trend.

Here's 3 charts showing the trends for a 200-day, 50 day and 10 day moving average.

200 day moving average

50 day moving average

10-day moving average.

Looking at the above, you can see the 10 day average is down, the 50-day is moving down while the 200 day is still up. While there are many combinations, this one suggests the market is moving from an uptrend to a downtrend.

No comments:

Post a Comment