I was just looking through some charts while StockFinder is running a scan and came across a C&D (Cats & Dogs) trade-FTWR.

These trades are speculative, they aren't for everyone and I personally reduce risk to 1% on these (cut risk in half), but they can move quite quickly for some nice gains.

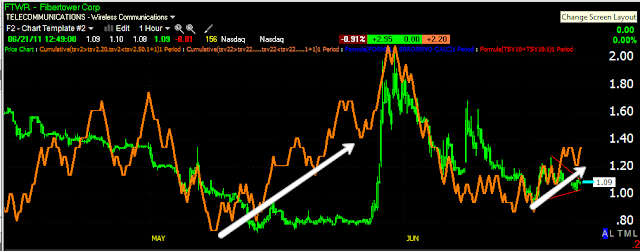

Notice the big change in volume as the downtrend ended. The last run in May was good for 131% in 3 days.

The 60 min chart reveals the accumulation before the last run and a positive divergence now in to a small , tight, triangle consolidation.

The 30 min chart showing the same, plus the negative divergence sending FTWR lower on the last run up.

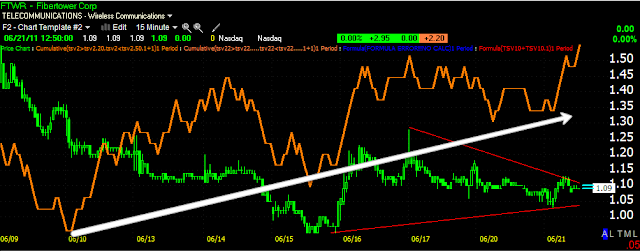

Here's a closer look at the triangle consolidation of the last 3-4 days with a positive 15 min. divergence.

You could always set an alert for a breakout around the $1.14-$1.15 level and let the stock prove something to you before entering.

The Trend Channel held the last move down for a 75% return, its current stop is at $.96 which may be too much risk for some of you. You can always wait for a breakout and put a stop near the breakout level to reduce risk. The Yellow ADX indicator also gave an early heads up that the downtrend was ending when t crossed down from levels above 40.

If you like these quick C&D trades (I personally prefer to take profits on any double digit gain), then you might want to set a price alert on this one. This is a SPECULATIVE trade.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment