I have alluded to this in the past few days in saying reversals are rarely "V" shaped, but perhaps a better lesson was something I taught in my classes, "Tops and Bottoms, whether major or minor, are NOT events, but a process".

There are many underlying indications that are not apparent by price alone that suggest we are working on a bottom, however we must remain balanced in viewing possible scenarios, such as the possibility of a French sovereign debt downgrade or simply the pessimistic sentiment, whether it be Europe, Asia or the US. We also face short term challenges such as today's nearly unprecedented quote stuffing which knocked the market down in late trade, so much so that the NASDAQ nearly had to reset during the trading day. This is the first time I've even heard this to be an issue.

As difficult as it is to say, based on the charts and many pieces of the puzzle, I retain a short term bullish bias and an intermediate and long term, very bearish bias. It may sound counter intuitive, but there are many different trends happening at the same time, whether it be a primary, intermediate, short term or ultrashort term trend, there can be a wide range of trends all at the same time. I sum this up as tactical vs strategic outlooks.

One chart I did want to share are the current pivot points for the S&P-500

As you can see, the market is more or less trying to make a stand at S1 and the last 3 days, the S&P has stubbornly retained the 1100 level, briefly touched on Tuesday at the lows. However, even in this hart you can see the larger top took nearly a month to unfold and the short term top took 3-4 days to unfold, thus it's a process, not an event.

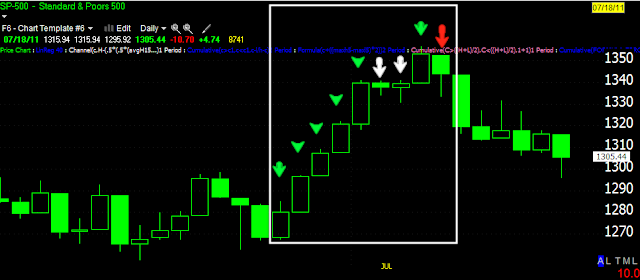

Another interesting chart is this one, remember trend classification

The first red arrow is the Monday proceeding the Fed's meeting with the Primary Dealers the previous Friday and when the downtrend started in earnest. A downtrend is a series of lower highs and lower lows, days that do not make lower highs and lower lows are called noise and noise almost always precedes a change in trend. As bad as today's trade was, it was the first day in the last 7 which did not make a lower high/lower low.

Looking back at our short covering rally, we see the same, except in an uptrend

At the green arrows we see higher highs/higher lows, noise candles in white and the reversal in red. Again, noise precedes a change in trend and becomes part of the topping/bottoming process.

Breadth Charts

While oversold cannot be defined as a certain area, the McClellan Summation Index shows how oversold the market is when compared to 2010 spike lows and price.

The NASDAQ 100 Advance/Decline ratio has certainly improved.

The NASDAQ 100 250 bar new highs/new lows shows obvious improvement.

The NASDAQ % stocks above/below their 15 min 50-bar moving average. For the first time since the decline, stocks above the 50 sma have hit 96% yesterday and 85% today.

GLD

We know there have been some 3C warnings in GLD, today the CME hiked gold margins by 22%, a move gold shook off pretty quickly, but knee jerk reactions should be put in proper context and remember the last time the CME was intent on killing a PM, Silver, they hiked every other day for 5 or 6 consecutive hikes until they killed the silver rally. Do I believe the CME has people inside that may have leaked the impending action, OF COURSE! This action may be problematic for some hedge funds that aren't performing so well such as Paulson's, now they have to come up with extra liquidity for their gold trades at a time when liquidity is at a premium.

The relentless CME margin hikes finally killed the silver rally.

We must stay alert and ready to move, but also unafraid to look at and weight the information in the face of a scary market.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment