In the last post I showed how rapidly some of the 3C timeframes were falling apart in the SPY/S&P. In confirmation, I took a look at several of the model portfolio positions and found that as fast as 3C is falling apart in the market, it is gaining momentum in the Model Portfolio positions which are largely inverse ETFs.

Here are some examples.

EDZ Short Emerging Markets 2 min is leading positive.

EDZ 5 min is strongly leading positive, the opposite of what we saw in the SPY/S&P

ERY-Short Energy 3x 5 min leading positive very strong.

ERY 10 min, strong leading positive.

FAZ 3x short financials, leading positive 5 min

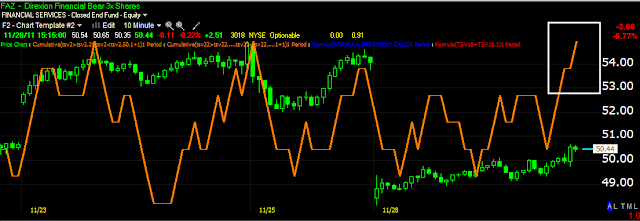

FAZ 10 min

SDOW UltraShort Dow-30 5 min, exceptional leading positive divergence

SDOW 10 min

SPXU UltraPro Short S&P-500 5 min very strong leading positive signal.

SPXU 10 min

SQQQ UltraPro Short QQQ 2 min leading positive

SQQQ 15 min very strong

SRTY UltraPro Short Russell 2000 1 min chart leading positive.

TYP Technology bear 3x 1 min leading positive

TYP 5 min leading positive

Even my long positions, UNG 2 min is looking like it is turning around to the upside with a strong 3C signal.

As well as URRE on a 30 min chart!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment