Today's market action came on mixed avg. volume (NYSE 817 mln, vs. 805 mln avg; Nasdaq 1700 mln, vs. 1735 mln avg), with decliners again outpacing advancers (NYSE 1156/1821 Nasdaq 1064/1430), but a bit more evenly spread then the last several days. This implies no overbought/oversold condition on a one day basis.

The dominant Price/Volume relationship in 3 of the 4 major averages was close down and volume down, this also implies no extended tension in the market.

To bounce or not to bounce?

I don't know if you recall how bad the 3C readings were during the market bounce of Monday/Tuesday earlier this week, but they were so bad they almost didn't seem real, that was until the market cracked fairly sharply. In essence 3C was showing distribution throughout the entire move higher and as it was briefly lateral near the highs. As I have mentioned, some significant damage was done to the near term charts as you can see by the leading negative divergence on the 15 min chart above, much of this happened in a day and that is rare to see on this timeframe.

Wednesday started a positive divergence and as I showed last night and this morning, toward the end of the day that positive divergence went negative and we gapped down this a.m. and continued building a positive divergence on the 1-5 minute charts. This divergence started to move up today in a "U" shape, so I'm assuming as of now the accumulation for a bounce is in place. Wednesday was more of a hand brake slowing the market's decent an today allowed the divergence to be put in place and price to start to move up off that divergence.

While the divergence is compact, it is fairly strong, however divergences can be measured somewhat by the amount of time they take to develop and how far out in the timeframes they reach. While this is a strong divergence for a 5 min chart, it is short in nature and hasn't reached the longer timeframes. My gut feel says it can pack a punch, but more of a sprint then a marathon, there just wasn't enough time to accumulate a large position that can go one for days on end so I'm expecting a fairly strong bounce, but short lived, it may even start to turn tomorrow. It seems as if this was rushed and the bounce needs to get done before some event which may be Sunday's Flash PMI out of China or some other event in the near term.

I don't view this as a continuation of the uptrend, but rather a volatility shakeout move.

There have been some strange events the last few days as well.

As I have shown you the past couple of days, the European market has been falling apart and it's negativ action seems to be effecting the US markets early in the day, that tends to be where we have seen the accumulation, during US early market weakness and then after the EU close our markets rise off the early divergence. This may in part explain the negative divergence late in the day on Wednesday as the US markets gapped lower today partly on EU weakness. Above is the DIA, Wednesday there's early accumulation in to weakness, after the EU closes, the DIA rises and then 3C sells off later in the day Wednesday. The market gapped down today and as you'll see accumulation started, but the price move up didn't come until after the EU markets closes and the dollar declined.

Here' the dollar intraday over the last 2 days, note early morning strength and the decline after the EU markets close, this has a direct correlation (inverse) to stocks and helps explain the afternoon rally of the last 2 days, why it is happening is a mystery.

Here's ES today during market hours doing the same thing, an early decline in to a positive divergence and price moves up after the EU close. Logically you would think the US markets would be under pressure with the declines in Europe. Note the end of day negative divergence in ES.

The IWM has done the same thing the last two days, you can see 3C's decline late Wednesday, but the market's rally only after Europe has closed.

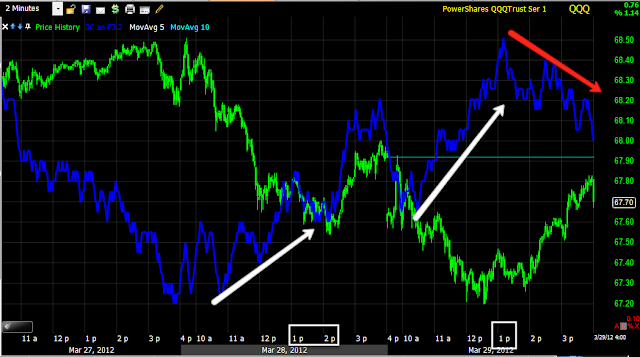

The QQQ doing the same thing.

And the SPY. It seems the positive divergences lose traction and fall more in line with price on the afternoon bounce, but there is still enough accumulation I believe to put in a real bounce and not just afternoon intraday bounces. However as I mentioned, I don't believe this divergence is big enough to really do anything other then create a bounce which could be emotionally moving, but there's simply not enough accumulation to suggest that this is a true bullish event for the market, it looks more like a manipulation/shakeout type event.

There are other curiosities as well.

The Yen, a carry trade currency favorite is seen above in the USD/JPY pair with the Yen falling hard Feb.-most of March, this correlates to the market' trend during this time and makes sense, but recently the Yen has gained ground suggesting the carry trade that is used to finance stock purchases is being unwound, thus some of the recent market volatility and choppiness.

A closer look at the daily chart shows the Yen gaining ground vs. the $USD, which makes the carry trade more expensive. The Yen broke its first resistance today and the next level is coming up just above $80, this will further pressure the market.

Looking at the Yen intraday, to the left the correlation is as it should be, the Yen spikes (yen in red/SPX in green) and the SPX falls, however the has been a more recent trend up in the Yen to the right (long green arrow).

Here's what is strange, but also makes some sense. The Yen drops at the yellow arrow and the market advances, at the Orange arrow the Yen drops a little further down and the market relatively compared to the last point is up about what you would expect from the correlation. However at the red arrow, the pullback in the Yen is nowhere as deep as the previous two, yet the market makes a higher high. This is the same high that has such a horrible 3C profile throughout, while it was happening and as we have seen since, that entire move up was used for distribution, whether selling or short selling. We can't discount Window dressing either, but the 3C trend there was very strong and very clear, it was negative.

The $AUD/USD above is showing the $AUD starting to trend down after having been in line with the market rally, the $AUD as we have seen is an excellent leading indicator for the market and this chart is probably not surprising being I have highlighted the divergence between the $AUD and the SPX numerous times in our Credit/Risk Asset Updates.

Here's what I'm taking about, the $AUD has diverged from the market and pretty much where the market has become volatile and choppy, often signs of a top reversal.

As risk assets go, the Commodity space is lagging the market, it's too soon to say if this is a divergence/red flag already forming or if they'll catch up tomorrow, but it will be monitored as commodities have given some good leading signals regarding market action. I do find it interesting commodities didn't perform better today on a weak dollar in the afternoon.

Credit I think we can safely assume is already waiving a red flag as it sold off all day, while the equity markets may run off on their own, the larger credit markets often lead stocks, so a market bounce with credit selling off will be a good signal to judge the health of the bounce and when it may be a good time to sell short in to some of that bounce.

Yields also seem like they are already warning and a bounce hasn't even really begun in earnest yet, this also suggests to me any bounce, however sharp it may be, will be short lived.

Here's the Euro, interestingly it is rallying only after the EU markets are closed and gapped down this a.m. on EU weakness.

Here's a view of the $USD vs the SPX and again, note that the Dollar only sells off after Europe is closed and the markets bounce in the afternoon on that dollar weakness, however if you look carefully, the dollar is strong in the morning.

So based on what I see, there's already long term broad weakness in the underlying trade of the market, carry trade currencies are reversing putting downward pressure on the markets, the recent rally we saw showed distribution through the entire move, and leading correlations every where are breaking down as Europe once again comes to the forefront with the realization that nothing is fixed. Furthermore the US economic data has either turned or has been bad for a while, only masked weakness by using seasonal adjustments. I think this reality is setting in.

I also find this last chart interesting because the last time ES did this was during the price highs early this week.

As Es rises tonight, which if it can hold through the European session, which I believe it can as Europe is oversold with a doji reversal in place, then the market should gap up tomorrow morning in to our bounce. What is interesting is that 3C in ES almost always moves the market fairly quickly, it is very rare that a negative divergence persists without ES responding and the last time this happened was at this week's price highs on Monday and Tuesday, I even remarked that it is very rare to see this happen and while it seemed as if 3C was out of whack, it pushed the market lower and caused significant damage to the longer term 3C charts. In any case, 3C is leading negative so deeply that it has upset the scale of today's earlier positive divergence that looked like this...

This positive divergence is the same as the one above, but because 3C is leading negative so deeply it has changed the scale so it all still fits on the chart.

The implication being that before the market bounce has even really started in earnest, ES distribution is already under way and very strong, which also suggests to me that the bounce will be sharp, short lived and see negative divergences in to that bounce almost immediately after starting.

If my thought are close to correct, this should give us a number of opportunities at low risk with very high probabilities. I have a feeling tomorrow will be a busy day and an exciting one.

No comments:

Post a Comment