After several months of quiet on the European front, undoubtedly helping US equity markets, a little over a week ago I started seeing initial signs that trouble was picking up again as I warned, "Europe has been out of the news cycle, but I suspect they are about to come rolling back in". Sure enough, it has started as everything in Europe seems to be coming unglued from a brief several month long respite.

First, I posted the Euro Top 100 Index yesterday which was hitting 14 day lows, nearly 3 trading weeks and just broke the 50-day moving average, take a look at the Euro close today.

This close is the lowest in 16 days (over 3 trading weeks) and well below the 50-day average. Today's close was at $219.15 was a mere 6 cents from making a new 40 day low, nearly 2 trading months!

It's not just the market that is coming unhinged,

This is both the major European market averages and major European Credit, both are falling apart this week.

Take a look at Italian Banks...

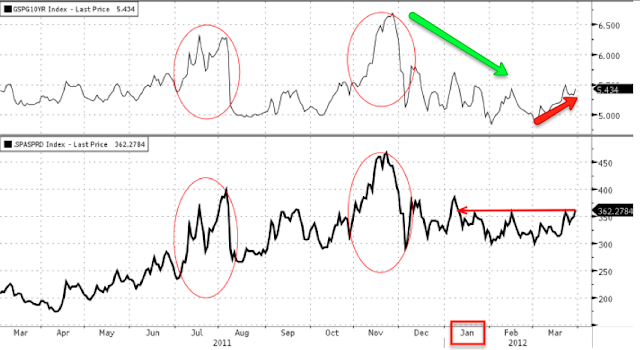

It doesn't stop there though, the LTRO, "Save the day, Hail Mary" ECB program seems to have lost its charm and sovereign yields are moving higher once again with Spain a notable problem.

These are sovereign debt yields, since the 27th, they have moved notably higher, both Italy and Spain among the worst.

Here's a long term chart of Spain's 10 year yields, they were trending down until March, they are now closing in on 5.5%, 6% is considered unsustainable, They are also back to where they were in January, so the LTRO effect is over. Italian yields are back above 5%, gain 6% is where Greece, Ireland and Portugal all had to go for bailouts. The short lived trend down in yields seems to have reversed.

Greece isn't any better...

Their new bonds are trading under 20EUR which means they are trading at 20% of face value! This is clear confirmation from bond traders they have no faith in any sort of Greek recovery and expect another bailout will be needed or default.

Also remember the charts I posted that showed how European banks are using about 200% more leverage then US banks and EU corporations derive 70% of their financing needs from the banking system vs 30% in the US. Well take a look at the bank run in Greece, even politicians have been caught sending Euros out of Greece as the general public pulls its money out too.

Finally, according to Mark Grant Spain’s OFFICIAL debt to GDP Ratio of 68.5% is way off the mark and Spain’s ACTUAL Debt to GDP Ratio is nearly double that at 133.8%.

The big problem for the EU is they can't afford to bailout Spain.

As pundits have made the argument that the US has decoupled from the rest of the world, while others believe it is only lagging, the trend in the macro economic data over the last month seems to be showing the US slipping badly. The real question is whether this is a new trend or whether it was always there and just masked by seasonal adjustments that can no longer be made to hide the true scope of the US economic data.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment