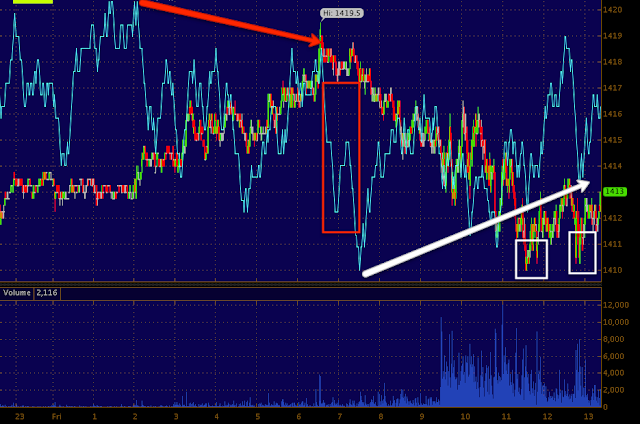

Here's an example of the "W" bottom intraday where the first divergence was joined by a second making a more powerful intraday divergence than the original.

ES 1 min.

The SPY, DIA, QQQ (to a lesser degree) and now the IWM have built a stronger positive divergence hitting the 2-3 min charts which are still intraday timeframes.

5 min timeframes haven't been moved and they would need huge divergences to move them out of the leading negative positions they are in.

Strangely the $TICK STILL remains locked between the VERY moderate readings of -750 to +750, it's almost as if there's NO movement in the market, which smells and feels a LOT like an options expiration pin on the weeklies.

Maybe some interesting candidates will pop up, since there's not much else to do right now other than watch the market hover around unchanged, I'll be looking at those as well as do some deeper digging.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment