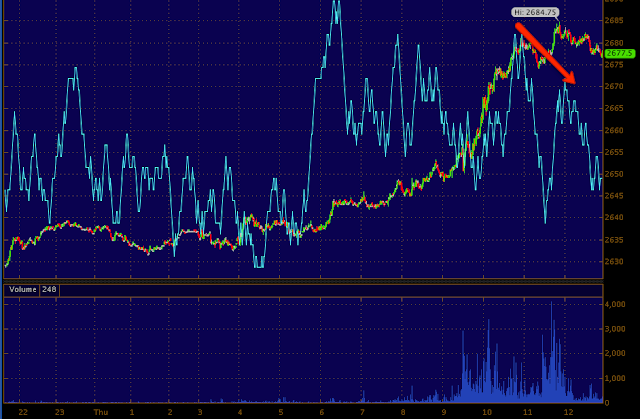

In any case, the NASDAQ futures are at a pivotal moment here and some of it can be understood through the leading indicators, some of it will depend on how the leading indicators develop in the next few hours.

This is an area where a negative 1 min divergence is big enough to cause a pullback in prices rather than just the loss of momentum and consolidation we have seen thus far.

Actually when you look at the FX correlation with the Euro getting pounded since the US open, it's rather amazing the market has fared as well as it has.

The normal correlation between the SPY (white) and the Euro (green) is a positive correlation.

The fact the Euro has been heading down all morning with the market moving up is rather impressive.

The EUR/USD since the 9:30 open.

Still the important $1.29 level hasn't been challenged.

No comments:

Post a Comment