Despite the overnight ramp in the EUR/USD which is supposedly because the Finance Minister of Cyprus remains "Hopeful" that a deal can be reached with the Russians (no other details-just "Hopeful"), you know there are economic problems when Fed-Ex looks like this...

This is bad economic news, not because of the Dow Theory confirmation of the Industrials vs. the Transports because we aren't an industrial dynamo anymore, we're more services oriented and Fed-Ex is representative of shipping for the services sector, they aren't moving coal, steel, grains, cars and such, they're moving goods and a lot of things related to the services industry. If you wanted to update Dow Theory you might compare Fed-Ex to the Russell 3000.

I'm not going to make a case on this one chart, but this is part of putting the pieces together to see the bigger picture, FDX did not make a new high with the Transports around 3/15. This might be one part of your analysis and if you found a trend of similar or confirming indications, you can start to build your case and see if it holds water.

As for the market overnight and the movement in the market today was all about the overnight session and the gap open, the rest of the day wasn't all that impressive.

While some say the Euro rallied on the "Hope" statement from the Cypriot Fin-Min., others think this is indicative of Euro repatriation flows, essentially EU banks selling overseas assets and converting the money and bringing it home to shore up their capital base which is the Achilles Heal of the EU. The problem I see is that most of the investments would come from the US and during the overnight session not many US markets are open to sell those assets. I think this could have just as easily have been ECB intervention to try to get back to EUR/USD $1.30 or it could have been algos just driving up the ask, whatever the reason, it drove Futures with it.

Again Swiss 2-year Yields fell again, further in to the negative (it's costing the buyers money to hold the asset), this should tell you something about the nature of the sentiment in the market. Credit markets in the EU which I showed you last week were diverging negatively away from stocks and it turns out credit was right as the Cyprus affair happened over the weekend. EU credit is lower now than when the Cyprus affair started so they are still very fearful, whereas European stocks for the most part just whistled past the graveyard (except Spain).

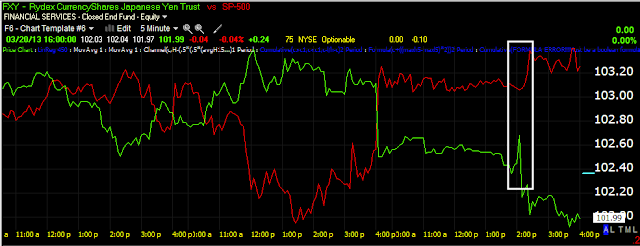

I'll skip over Bernie for the moment and head to Japan where the Nikkei reported that the BOJ Governor is going to call for "Bold Easing", which is such non-news. I mentioned the Yen yesterday and showed you some market correlation and as it were the Yen was losing it's downside momentum that Japan wants to keep up so they regurgitate this story that everyone already knows and it does the trick, they jawboned the Yen lower.

Here the Yen moves lower on the news as it was in danger of more lateral movement.

Interestingly, the F_O_M_C statement which to me was a progression of the drawing down of expectations that started as QE3 was announced in September, continued today; perhaps that's why the F_O_M_C release was so bland as far as the market was concerned, this wasn't anything like a normal, initial knee-jerk move.

The 2 p.m. release just didn't do much, nor did the press conference, after hours as you can see (2 blue hash marks next to price) is not thrilled with ORCL earnings.

Context may not be that surprising to you..

ES vs the CONTEXT model.

However as I suspected earlier in the week, Credit and a few other risk assets used in the Risk Asset layout, were used to try to ramp the SPX up to that new closing high, I was shocked to see it again (now confirmed that was what was going on) and even more shocked that it didn't work for the 4 measly points-lets just get it over with already and move on.

Check out the SPY Arbitrage model and especially later in the day after Bernie failed to ramp the market, the model is ABOVE the SPY and I can show you why, but I can't help but about how weak this market must actually be if the F_O_M_C, Bernie and these coordinated ramps couldn't pull 4 points for the SPX. The safe haven buying is clear and the willingness to sell (FDX / ORCL are reminders) is clear as well, there just apparently isn't enough willingness to take risk on for 4 minuscule points.

I first noticed it in the very liquid High Yield Corp. Credit (HYG)

First HYG seemed to step in to move to highs of the day on exactly what? Well whatever, it didn't get the SPX any higher.

Junk Credit was in there as well, just as the SPX was starting to come down, credit comes to the rescue, but doesn't make the 4 points.

The radical moves in High Yield Credit (as it is less liquid) took way all of the gains for the year in two days and then popped back up (again it's low liquidity), but check this out...

As HYG in blue failed to ramp the SPX, it looks like HY in brown got scared and sold off.

It even looks like VIX futures ended the day stronger than the correlation would otherwise suggest, perhaps reaching for protection or just an inaccuracy in the ETF?

Normally the VIX would be making a new low with the SPX making a slightly higher high.

And you saw plenty of posts on the VIX futures today, they seemed to have plenty of interest.

As for FX...

The really tight correlation with the Euro slipped at the end of the day, more than it has the last 2-days, wonder why?

The $USD was seeing strength since the gap down and especially in to the close, not helpful for the SPX.

The Yen probably doesn't hold a lot of meaning here, I wouldn't think this is significant other than the fact the Japanese are desperate to keep the Yen down until the new BOJ governors can try (they are only 3 of 9) to embark on their bold new QE to quell 20 years of deflation.

More on the Yen...

The trend in the EUR/JPY has recently broken and the Japanese aren't happy about it, they want this chart rising and the Yen falling, but this could very much be indicative of the wrapping up of the carry trade, breadth seems to suggest that pretty strongly, whatever it is with the most dovish PM and new BOJ leadership ever you'd think this chart would be soaring vertically, but the BOJ needs to come out and tell the world again and again just how serious they are to keep if from falling and if the Carry is being closed as I suspect, they may have a hard time.

This is the lateral movement they don't like, they want this chart moving up, not down.

You can see the BOJ's jawboning today, I think I'll chuckle or maybe even "LOL" if this chart falls and the Japanese come out again and tell us how super, super their QE is going to be, each time infuriating the Chinese.

A for Ben, the bottom line today is I didn't see anything that really stood out in the market, a few things here and there, but there was definitely a continuation of slow boiling the frog, he mentioned more than once the costs of additional easing vs. the benefits as well as "reviewing efficacy, costs and risks" as if he meant risk to the market as in a bubble... and you heard that hear before you did from the F_E_D as it has been obvious ever since they changed their Calendar based "yard stick" to a much more arbitrary and easy to manipulate, economic based. I guess they found it was going to be hard to manipulate dates on the calendar :)

The futures don't look very impressive, but I'm going to give them some time to get over earnings and see what happens later tonight, I'l just remind you of the signals in the VIX futures (yesterday's and today's).

Oh, by the way, tomorrow is a pretty heavy economic day, we have:

I'm sure I'll post again tonight before I turn in, I do think this market is a lot weaker than people realize, FED-Ex's sell-off, DE's, and of course ORCL are what happens when the market is let lose to discount, at the same time every little ramp trick can't get the SPX up a fraction of a percent to new highs, while the safe haven flight is everywhere around us.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment