His response to me was:

"This suggests the bulk of the upside will have to come from a combination of upside biased HFT algos, short covering panics and, eventually, bulls jumping in long on the assumption the market has reversed. "

My response to this was the following:

"That's the obvious stuff, but I wouldn't be surprised if the F_E_D let a rumor slip, picked up by the WSJ that helps, remember they have a lot closer relationship than they disclose as evidenced by the minutes being emailed to 154 trading firms over a day early. They'd rather see them make money in the market than have to bail them out.

That's just one theory, but there could be numerous things along those lines."

So is it just coincidence that two of the F_E_D most Hawkish members came out today sounding like doves? It was Kocherlakota and Dallas F_E_D's Fisher.

Kocherlakota said, "There is a mis-perception in markets that the Fed has turned more hawkish."

This coming from a hawk! Fisher was also putting out similar dovish comments, again another major hawk. So was my weekend theory just a lucky guess, or does it really hold water? So far I have to say, I'm really surprised that this comment from Saturday has been as accurate as it has been, not Hilsenrath, not 1, but two F_E_D members and not doves, but the Hawks!

Time will tell on that one and I don't really think it will need very much time. This morning in the "Pre-Market Update", " I wouldn't jump to any conclusions to fast, "

Europe was down as could be expected after Asia, but a curious thing happened. Considering European stocks broadly were at lows for the year, you'd expect a flight to safety trade, but the Swiss 2 year yield jumped up over 10 basis points to a 22 month high (Yields move opposite the asset) so where's the Safe Haven trade today? I think al things considered, that's not only an interesting question, but perhaps not a very surprising development, money pretty much either flows to risk assets or to safe haven assets, there's what you might call a disconnect or a sort of dichotomy today.

In the U.S., it's hard for me to make the same comparison between say TLT (20+ year treasury bond fund) and the market because as I've been saying for well over a month, I think something big is happening in TLT and this is actually a position I was long and would like to be long again.

While I have no argument whatsoever with the market being "Done", in fact I said I thought it was done on May 22nd when we put in a One-Day Key Reversal (we haven't been able to make anything stick above that level for more than a day) and I've made the case for a lot longer than most with the charts to back it up, but things aren't always as simple as we suppose. We think the market is bearish, the market is about to drop like a rock and then we have expectations that it does so immediately, that's not how things work, so I would not judge this chart too quickly either, just as I said this morning when it was clear we'd gap down.

The daily SPX with a 100-day ma.a. and 2 strong bodied down days followed by a high volume (Friday) with support right at the 100-day, today's break below the 100 seems clean, technical text book, but this is exactly why I wouldn't pass judgement so quickly on this chart.

That was the exact same advice this morning...

We started the day with an overnight slide causing a nasty gap down, but after that the market didn't do much more on the downside, in fact it built a range and headed higher, the only late day resistance along the 10-min 100 bar m.a. at what I earlier called a bull flag- this wasn't a gap fill, which I'd feel less confident about.

Last night I showed you the 30 min negative divergence in the $USD, with the correlation the way it is now, that is bullish for the market in the near term, I will tell you though once you get to the heavier underlying flows like 60 minutes, it's exactly what I'd expect to see for a market on it's last leg (perhaps even pinky toe).

If you need to see the correlation with your own eyes, here you go.

This shows the mirror opposite or inverse legacy arbitrage (historical $USD) correlation since last week when it flipped, for goodness-sakes (I never thought I'd use that word), look at today's action alone!

Remember earlier I said the 1 min $U?SD chart was pretty much useless so I looked at the 5 min and said, "This is the near term path of highest probabilities, the $USD follows the larger trend of the 5 min $USD and falls" that's what allowed the market to make some upside gains off serious opening lows.

Following that logic as 3C divergences move from short to long and in a situation where the longer term is already in place, all they need to do is connect. So the 1 min moved based on the negative in the 5 min...

5 min $USD

In similar fashion the building pressure on the 15 min chart should move the 5 min lower and link these timeframes up with the already leading negative 30 min posted above. That means a fairly significant $USD move down, you know the current market correlation, which just so happens to have confirming signals on the Index futures' 30 min charts as shown last night.

Interestingly, the same process described above for the $USD is playing out in the different timeframes in the Index futures like ES.

The 1 min chart, like the $USD is almost feeling a gravitational effect from the 5 min, as the 1 min and 5 min strengthen, so does the 15 min which in turn pulls on the 1 and 5 min until the gap between 30 min and the lower timeframes is connected, this process shouldn't take long at all. In fact last night I said, the following to give you some idea of what to expect...

"NQ 30 min shows the same, so in my view (same as last week), it's not really a matter of if, more when (which I think is just about anytime as the process is pretty advanced considering volatility) and the other question is "How", will there be a final head fake move, a gap up, something else? I'm pretty sure Wall Street isn't going to just make it easy unless they want to encourage retail to jump on the ship, if they make it easy, they are like the vampires inviting you to dinner, but we can still play the move."

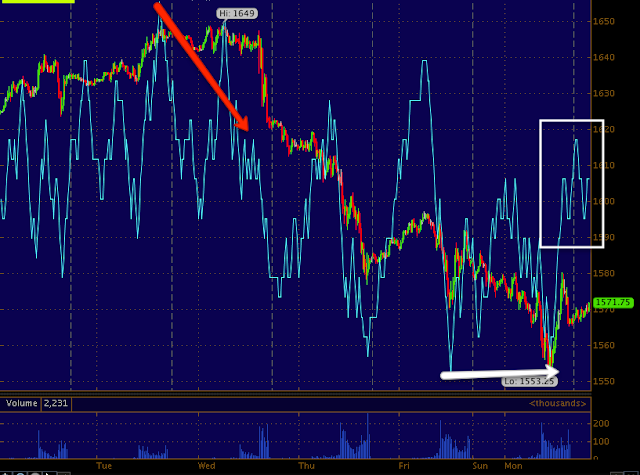

This is the 5 min ES chart, not only improving and exerting influence on the 1 min, but as usual, migrating to the 15 min, the connection is almost made.

ES 15 min

I don't want to make too many assumptions about what we see in Es's VWAP, but I can certainly see the argument made that this area that we have been seeing accumulation in since last week, could be considered to be confirmed by VWAP.

No market maker or specialist filling sell orders would have a job very long if they were filling at the lower ES S.D. and at VWAP as the best price. It could however be said that the middle man would be doing a damn fine hob in accumulating under VWAP, whenever the market moves to VWAP they work the bid/ask and maybe let out a little supply until they are at the lower S.D. of VWAP.

As far as the late afternoon move today, do I think (by that reasoning) that's selling? I'd say if you looked at the divergences, where they started higher and how VWAP has been acting, I'd say this is the start of a move and not distribution at the upper S.D. of VWAP, for any price move to begin it has to cross the upper S.D.

So that's interesting too.

HYG (Credit) as well as the illiquid High Yield Credit and our sentiment indicator HIO (to a degree FCT as well) weren't leading the market lower as they'd usually do when a move lower is coming or a leg lower, they were nearly in lockstep with the SPX all day, for that matter, so were treasuries, but again I think something bigger is going on there and I think they'll head significantly higher so any chance to add to them down here being taken wouldn't surprise me.

In FX, the Euro and the $AUD were at least supportive intraday and moving closer to the correlation they use to have many, many months ago, in some cases they are leading the market a little so there's some supportive behavior there, although not jumping off the chart.

Yields also remain supportive and are at one of the larger dislocations they have been at. As a reminder, yields act like a magnet for equity prices, they typically revert to the mean and meet up with each other, that could happen by yields falling, but as I already said, most often it is yields that act as the magnet for stocks.

Yields in red and the SPX in green.

I've seen some people since the market close (mostly on Worden chat) noting that commodities were not showing the same relative strength as the SPX, or they were not as supportive as one might expect, but as we already know the $USD is going to be the main driver of price now, not the USD/JPY like this time last week. If we look at commodities vs the $USD, commodities acted EXACTLY as they should have today, there's no point taken away from commodities relative performance vs the SPX.

Commodities in brown and the $USD in green, a nearly perfect inverse (legacy arbitrage/historical ) relationship.

If I replace commodities with a specific commodity, oil (USO we see the same relationship occurring...

USO (brown) vs the $USD.

If we take that a step further (as you know I really liked what I saw in USO today)...

USO 1 minMigration through USO 3 min

A pretty strong 1-day move in USO 10 min.

If these divergences fire off and we have no reason to believe they won't, what does that tell us about the tight correlation of USO with the $USD? It tells us the $USD moves lower as the $USD futures show (and were shown last night) and what do we know about the market's most recent correlation with the $USD? It's inverse or opposite, therefore following the logic leads us to higher USO, lower USD and higher....SPX.

If that chain of events is correct, then we should see it in the averages, I didn't draw on these at all and remember I didn't expect to see much past 5 min, maybe 10 min here and there, but nothing in 15 min+.

(large 1 day moves on a 10+ min chart are indicative of strong last minute accumulation)

The IWM 10 min is also leading positive, you can see where it went negative (distribution) before prices fell.

The QQQ 5 min isn't as strong of a timeframe, but the divergence certainly is strong and long enough to be a serious contender.

And the SPY 10 min leading positive, again the main story here from a 3C perspective is the speed and size of a 1-day move on a 10 minute chart.

The overall message is that which we'd expect from following logical correlations should show certain divergences in the averages, there they are, they're in the Index futures as well.

I'm not going to chase down all these stocks to make the point, but they are in the bellwether stocks as well. As I showed you earlier today, AAPL didn't see that much volume on the break below the two triangles, it did see it on the break below the psychological level of $400 which I posted about before it happened today, look what they did with the volume (and this speaks to the NDX-100 because of AAPL's weight).

Not only did the 10 min 3C chart fly, but the volume that hasn't bee there for a stock as large as AAPL, showed up today below $400.

That's going to be it for now unless I see something crazy in the futures. As I said, the market is not going to make it easy for anyone long or short. If you were short this morning then you started off very excited and then grew more and more worried as the day went on, I felt it as I closed half of a +22% gain in a core short, IOC; when I closed IOC it was down over 7% intraday, it closed just over -5%, so I made the right move at the right time. The point is, the market will try to scare and shakeout longs and shorts alike, those guys on Wall St. have expensive cars and homes in the Hamptons as well as some things I won't mention here, to pay for, it doesn't matter to them where the money comes from, it's a zero sum game so taking it from longs or shorts is irrelevant.

I'd just remind you of the volatility, just like this morning and today's market, "Don't judge too quickly), including the SPX just under ,the 100 day and try to make decisions and analysis objective, not emotional which is as subjective as you get. You get paid to take risks, they should always have probabilities and an edge, we aren't gamblers, but it's not really accurate to assume everything moves as you expect (actually it may move as you expect, just the way it does it may throw you for a loop).

Right now, the intraday 1 min ES and NQ futures are leading positive, the $USD is leading negative and the Nikei futures look decent right now.

No comments:

Post a Comment