Even the engine that we speculated to drive the market today, SPY Arbitrage, was the engine until the market could get a short squeeze in Russell "Most Shorted Stocks" going.

While the other averages started looking like they were seeing the kind of distribution expected (for a short 1-day bounce), the R2K/R3K's short squeeze looked impenetrable until the end of the day when TICK data hinted at problems and then the IWM itself followed up with a negative.

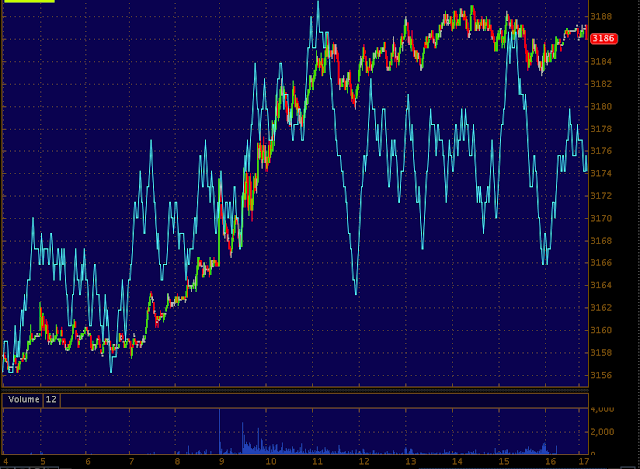

The ending divergences intraday (remember these were going positive in the later half of Monday afternoon), looked like this.

DIA leading negative in to a flat range which is very typical for distribution and expected based on the size of the positive divergence which wasn't that big.

I'm not going through the entire timeline of how all of this developed because I've posted it numerous times, but starting with a late afternoon positive yesterday, a beautiful positive in the overnight session and as we guessed or predicted, the SPY arbitrage to light the fire, the only thing I didn't see coming was the Russell short squeeze, but considering smart money wasn't going to want to be long credit in to tomorrow, the SPY arbitrage had to fail as money moved out of HYG (credit).

You'll notice all of the averages have deep negative intraday signals except the IWM or at least not as bad as short covering there was keeping the IWM alive and well.

QQQ intraday leading negative with AAPL and the Tech sector seeing distribution.

SPY leading negative

And finally as the TICK data stumbled showing the short squeeze was losing momentum, the IWM goes negative and makes the first lower low of the entire afternoon at the EOD (yellow).

Just like last night, I have a strong feeling that overnight futures are going to provide the same strong influence that moves trade tomorrow and the IWM looks exceptionally exposed here as do many other averages and stocks.

In fact, as early as it is (and last night I purposefully didn't check futures until they had time to move), here's an early look at the Index futures this early in the night.

ES/SPX doesn't look good, but damage was done during regular hours, still I'll be checking in on these later tonight as there may be a great opportunity for an opening or early position.

The NQ/NASDAQ 100 faltering.

And TF/Russell 2000 which was in line all day long until just recently in to the close as we saw elsewhere (3C on IWM, TICK data, the most shorted index, etc.).

Here are some other short and longer term notable charts, first with some Leading Indicators...

VXX shows VIX futures were bid up today as I have inverted the SPX to show relative performance, this isn't so strange before an event like tomorrow's policy statement, but there are some larger issues that need to be considered.

Our professional sentiment indicator FCT, moved with the SPX on the way up (as we expected a strong move up and the FRP video explains exactly why, stocks like AMZN today were part of that reason why).

The falling off in sentiment today is an extreme change in character, but like I have said recently, we don't want to get lost staring too closely so take a look at what sentiment has done on a larger scale.

This 15 min chart shows sentiment in line with the SPX and at the rally that we'd expect to see strong sentiment "IF" Wall St. was buying it, has totally fallen off and right at the start of the move which suggests this is the cycle (manipulative-again the reasons are in the FRP video) is absolutely Wall St. created as we said they'd need to do BEFORE it even happened!

Yields that act as a magnet for the market went from positive in the accumulation zone of this cycle and were in line at the start of the move and have since fallen off badly, they'll be exerting downside pressure on the market.

However, this was the biggie that I almost couldn't sleep thinking about how it would turn out today as I said yesterday, this is probably the most important indication and today would tell us a lot.

The further losses in the institutional risk asset of HY Credit tells us Wall St. is VERY nervous about something and I'm not sure it's just the uncertainty of what the F_E_D will do tomorrow, we have seen cases where the F_E_D has leaked not only minutes to 154 Private equity firms via email a day before the release, but we have seen policy statements leaked 2 hours ahead of the statement or perhaps more.

Commodities got slammed again today, gold, silver, oil (PMs are acting as if they are looking for a taper).

Longer term objectivity...

This is a clean uptrend channel in the SPX for most of the first half of the year, the red arrow is the important key reversal day, a very bearish signal on 5/22, from there it acted like a channel buster with a quick move below the channel, this was and still is an important event, I think when we look back a year from now these are going to be some conceptual red flags for the tool box.

Technical analysis expects a "Kiss of the channel goodbye" and the channel to act as resistance, but as I have shown over and over, Wall St. knows what technical traders expect and now these channels are almost ALWAYS shaken out by a return back inside the channel.

However the thing to really pay attention to here is the deterioration of the channel.

Add a simple ROC on price and you can see where price starts deteriorating -as they say, "The trend is your friend until the end when it starts to bend".

March looks like a clear winner for the start of the deterioration of the trend, so what happened with stocks around that time?

Breadth Indicators don't lie, they aren't up for interpretation, they are hard numbers like this one showing the Percentage of all NYSE stocks trading ABOVE their own 200 day (considered to be a bull market when above) moving average, that percentage should climb with higher prices, instead it tops out at 81% and continues to fall throughout the year to about half of all NYSE stocks now are either above or under their 200-day ma.a, considering where price is, this is about as ugly as I've seen breadth.

The stronger momentum stocks Two Standard deviations ABOVE their 200 day moving averages fall from 42 % to less than half that now, 18%, and you wonder why 3C has been showing distribution, these stock's price has fallen below long term moving averages, that doesn't happen unless they're being sold or "Distributed".

If you've followed my F_E_D analysis since Sept. 13 2012, you know exactly why I think this is, because the F_E_D has decided back then that this was the last QE and started making motions to make that apparent and to make that happen. I can tell you the exact time on Sept 13th I noticed it, 2:24 p.m. during Bernie's press conference when he gave an odd answer to a question that showed a huge shift in F_E_D thinking.

This is the Summation Index of the McClellan Oscillator, a cumulative line of the MCO, this should be moving higher with price, instead it's just off new lows as price is near or at new highs (absolute or regional).

I found this chart of VIX Futures today interesting, look at the spike, new high they make toward the close and look at that volume, it makes sense considering tomorrow, but...

When we look at this 30 min leading positive divergence of the $USD, this looks very much like FX traders expect the F_E_D to announce a taper as the $USD would sink otherwise.

Something seems a little out of place, but you wouldn't know that if you were chasing price only.

Finally, setting aside the spike in VIX Futures or a bid for protection from market downside on huge volume, the longer 30 min chart's divergence is clear.

This isn't the kind of accumulation that is last minute before the F_E_D, this is the kind that takes time to accumulate and the 30 min leading is huge.

I'm not jumping to conclussions, but the objective evidence doesn't look good for the market.

The next test is what the futures do tonight...

I'll check back in after some time has passed.

No comments:

Post a Comment