In any case, I was looking for momentum to pick up at $33.50 and even suggested a limit order there which I never use.

These are the charts as I captured them, but as suspected, even on this low volume, momentum picked up as $33.50 was passed.

CL/Brent futures accumulating at the knee-jerk drop...

The daily chart and the area where a shakeout becomes a head fake which creates upside momentum. These are seen about 80% of the time right before a reversal.

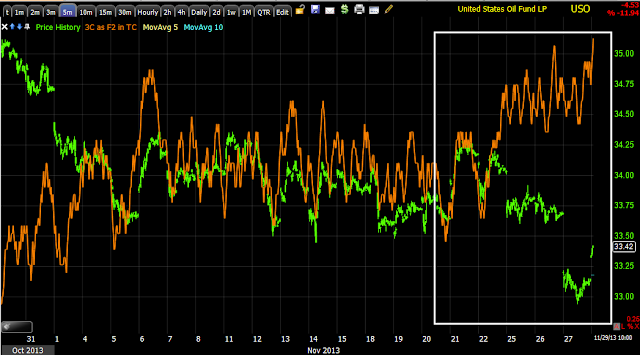

This is what USO looked like when I started this post.

This is the accumulation of the stop-run on the Iran/Saudi news

Migration of the divergence

And a very strong 5 min chart.

Now...

Note momentum right after a brief stall at resistance.

I wish I had put this in the trading portfolio, maybe I will if there's a slight pullback to support, but I did add to the options that have gained quite a bit this morning.

There's a much larger bullish picture for USO we have been following for months, I think this is the door step to that much larger picture with a target in the $38+ area.

No comments:

Post a Comment