I hope everyone had a great weekend.

As of Friday's last post, I saw the market in this light,

"Looking at leading indicators and others, I'd say they are consistent with what I said before, "If the market can put together a retracement/bounce from oversold (which is relative or subjective), the indicators don't hint at anything more than that possibility, thus the reason I won't go long any market correlated assets for a bounce, I'm saying there would need to be more of a basing process, an unwind of the very bearish action, which is ironic, because Investor .com had the highest bullish sentiment seen by our resident sentiment follower as today began!!!"

Putting aside weekend developments for the moment, from what I see in futures, I think this is still fairly likely, we'd be looking at something along the lines of...

This is what I was saying Friday would be a more lateral trend creating a small reversal process, if other events that have taken place over the weekend don't get worse and turn us toward a 2008 like environment.

The bottom reversals like this are tighter than the preceding top reversals which you see above and quite clearly on a 3C chart of strong distribution in the very same area I pointed out with a USD/JPY vs. ES comparison chart in which the Carry Cross underperformed the market significantly, thus distribution making sense especially as we know for sure BAC's top technical analyst was looking at the same thing last week and revised their bullish stance to neutral.

This is the area I was talking about in red, the BoFA analyst talking about the carry cross and ES in much broader terms.

What would be interesting (and note my visual representation is just a general trend, not any prediction of the exact shape, volatility or length.

However, it would be pretty close to maturing right around this week's Wednesday F_O_M_C policy statement at 2 p.m. as seen below in red.

Now I think the F_E_D wants out and consensus is for another taper of another $10 bn at this meeting, but there's always the very high probability of a F_O_M_C knee jerk reaction which I ALWAYS warn of, which is usually reversed in a day to a couple of days. The F_E_D could taper, but have a more dovish tone and since expectations are already for a taper, that "could" work out just about on cue for the trend I was envisioning for early this week as you can see from the first paragraph of this post.

In that case, there's not much to do early on, the only way I'd consider trading an upside bounce/correction is if 3C gave clear signals in a reversal process such as I've drawn.

I don't mean reversal as in go back to a healthy uptrend or anything like that, I simply mean the normal bounces we see in waves, especially after a move down like we've seen last week.

As of Friday I didn't have a whole lot of 3C evidence to go on that supported this theory, tonight I have a little more. In this situation there's an several possible opportunities, but I don't see the need to do much, I'd still leave trading and core shorts in place generally speaking, I "MIGHT" consider a quick bounce trade if the signals were there in a reversal process, but they have to be very strong because I think we'd be trading against a very bearish underlying tone in the market, heck a bearish price trend in the market, especially in carry trades.

Any bounce would be the real opportunity to short in to strength, take my BIDU idea, hitch hike a bounce higher as I opened some calls Friday and then set up core short positions in to the relative price strength (or add to positions and even trading positions), so the real bulk of movement on our part wouldn't come until mid week and that's assuming some early signals suggesting Friday's commentary posted above is correct.

OK, so as far as what I had as of Friday, some weak, but noticeable Leading Indicator signals, a few 3C signals in particular some starting in the IWM, again weak, but tonight while Asian markets are getting hammered, US markets are roughly unchanged from Friday's close. In addition, I have something else far more valuable...

ES 5 min positive divegrences in to the opening of futures for the new week, now leading positive.

The same for Russell 2000 5 min chart

And Nasdaq 100 futures.

Don't get me wrong, in my view this would just be a start and the process would have to mature, but Wednesday looks like a reasonable maturity date considering the proportionality.

Also notice the build in volume, to me that looks like a short term oversold or washout event. I'd say early in the week we'd see some volatility carry over from last week and then lateral chop which isn't the best trading environment, but we want to see that and confirm the 3C signals, we can make choices whether we want to play some hitch-hiking trades, but the big picture is to still use any price strength to short in to and once again we'd verify distribution in to any bounce or retracement which would be perfectly normal.

The real evidence that say, Use any chance you get to short in to price strength " is the longterm or strongest underlying tone, take the 4 hour Index futures...

ES relative to deeply leading negative, this damage doesn't get fixed, in fact it likely gets worse in to any price upside which gives us a great edge to short in to strength or to add to shorts in to price strength and I USE THE WORD "STRENGTH" WITHIN A VERY RELATIVE CONTEXT.

However, bear market counter trend rallies tend to be some of the most impressive. While the trend isn't technically a bear market, many other assets that are highly correlated are moving in to a bear market, the carry trades being on of the most significant.

NDX 100 4 hour leading negative divegrence.

Russell 2000 4 hour leading negative divegrence after significant distribution to the left.

This is still early information, but it fits the opinion I held based on what I saw Friday, in fact it adds some credibility to that opinion.

Except for the IWM, there are no real positive divergences in the averages so they would need that lateral or "U"/ "W" shaped lateral movement too put those divergences together (as mentioned late Friday the IWM got a head start.

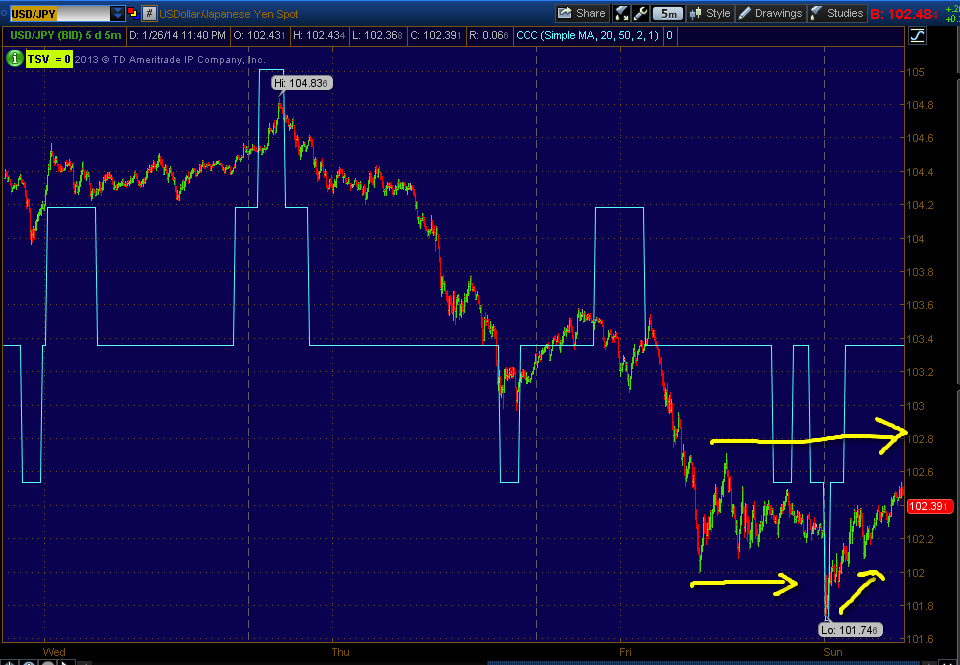

One other signal that I noticed, I mentioned Friday that the USD/JPY and EUR/JPY as well as the Yen and $USDX were all traveling lateral while the market was down, this was relative strength in the carry crosses, look what else I found tonight.

The USD/JPY moving sideways Friday, it opened lower tonight and bounced back up in to the lateral range.

For the USD/JPY to help the market or just maintain its correlation, we'd need to see the Yen come down and the $USDX move up, so this is interesting...

The 15 min single currency Yen futures with a 15 min leading negative divegrence. This in no way cancels or changes the Yens larger 2014 trend, but it does suggest it pulls back as it has before advancing higher each time this year.

The USDX/$USD would need to move up and guess what we have on the 15 min chart, a leading positive divegrence so we have good early confirmation on the opening of futures for the new week.

In addition I have a gold 15 min negative leading divegrence as gold has been trading opposite the market and I have a 30 year treasury futures leading negative divegrence so I think we have pretty darn good evidence to say Friday's opinion is showing confirmation.

Again, the market would need to do some sideways/choppy lateral work to create that reversal process and I don't see this as anything more than an oversold bounce that will be a gift to short in to, but we would certainly keep an eye on developments, the probabilities though are already heavily skewed as the 4 hour Index futures charts show. Those charts say, "hold shorts during down moves and add to them in any moves up".

So I think we have the makings for some good set ups, maybe some long hitch-hiking trades with calls or leveraged long ETFs as I don't think a regular equity (SPY long) would be worth it, no market longs may be worth the risk, we'll just have to let the market tell us.

As far as the Fundamental news I mentioned, we know about the potential Chinese Trust default that may be coming up this week as well as concern over their mining industry defaulting on their loans. The huge liquidity injection last Tuesday suggested (as the market rallied on the news) that there was big trouble, a liquidity lock up is what caused the Bear Stearns/Lehman era bear.

So in addition to that UK banks seem to be concerned or having their own liquidity problems. HSBC was apparently giving customers who were making large withdrawals a hard time demanding to know why, since that story broke they cut out the nonsense as that is more likely to cause a bank run, but they are apparently worried about liquidity for some reason.

In addition Lloyds banks (3 subsidiaries included) are having ATMs "out of Cash" and customers having problems using their card to complete transactions with transactions being declined. Lloyds has only said they are working to resolve it, but this doesn't have a very rosy smell to it, essentially 4 IK banks or two large ones are seemingly showing signs of a liquidity crunch, it was bad in the US but if we see a global liquidity crunch/credit market freeze, just imagine what the market would look like, 2008 would look like a stroll in the park!

Things are obviously not looking good in China and elsewhere and timing is very interesting considering the concern over Chinese defaults and Shadow Banking trouble.

In addition, Japan posted the largest annual trade deficit ever! Japanese Credit sank, the Nikkei 225 which is similar to the Dow in size (points/percentage) was down -400 points or about -2.60%, Japanese Yields fell hard as the flight to safety trade commenced in to bonds and as I posted in April 2013 (you can read the articles linked on the member's site under "Currency Crisis" ) as it seemed evident way back then, Abe-enomics and Japan's monster QE that seeks to double the monetary base in 2 years, looks TO BE AN ABSOLUTE FAILURE, THE TRADE DEFICIT IS JUST ANOTHER CONFIRMATION IN A LONG LINE OF THEM AND PERHAPS THIS IS WHY WE HEARD THE IMF TALKING ABOUT JAPAN AND STARTING TO LOOK FOR THE END GAME FOR QE-ZILLA WHICH ISN'T EVEN A YEAR OLD YET.

It seems to me the market is progressing or digressing along the lines of the extreme 3C signals, as we know, we can see the 3C signals and the distribution, we just don't know the back story until later and if you wait for the back story you missed your chance to make money.

So I think we have been positioning ourselves well, I am happy with the way things are progressing, I think there's an opportunity here that likely hasn't been seen in more than a generation for those who understand the market dynamics and figure out the new dynamics and have a real edge, I think that's us and I'll be right there with you as I'm not missing this one, in fact I put off buying a house to be in this market.

PLEASE REMEMBER THAT I HAVE SURGERY TUESDAY AS I HAVE BEEN MENTIONING FOR THE SKIN CANCER UNDER MY EYE, I WILL BE BACK IN FULL SWING WEDNESDAY. However I think Tuesday is probably the best day for this if my theory is correct as the market should still be lateral in a basing process.

I'll see you in a few hours, I have to say, I am excited.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment