Good morning,

So far the averages hand Index futures have a weak enough intraday start that they should be able to make it a bit lower and form that "W" base.

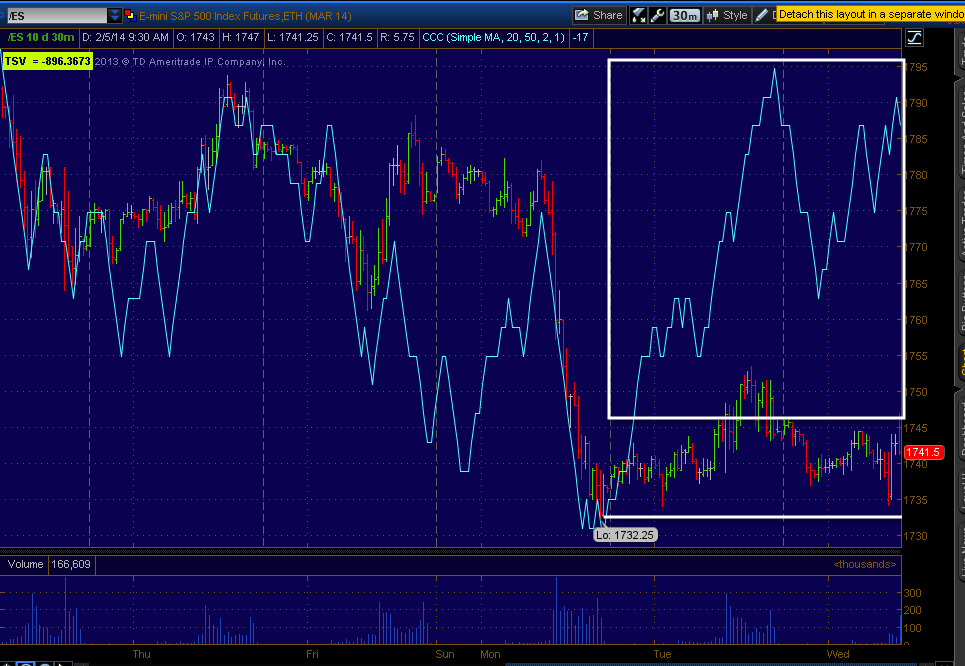

The longer charts are still plenty strong enough to launch them higher after that is completed, at least that's what I suspect the market is going for. Here's an example using SPX futures ...

To the far right is this morning's regular hours open with a 1 min negative divegrence and the averages have the same which should bring them closer to the "W" bottom.

At 5 min I wanted to see this chart improve and it has considerably so it looks ready to support a base.

The more important chart and you can see the "W" more clearly is this 30 min which is also strong, the averages are similar to the SPX futures as far as charts.

Currencies looked like they were about to (actually did start) to strengthen on the US open, the USD/JPY specifically, now it's kind of in limbo, seemingly waiting, but I want to keep a close eye on that as it's really running the show.

In any case, we opened at a decent spot to create that "W" base, lets see what happens, it shouldn't take much more than half the day I would think.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment