The IWM Put position, these are the profits I want to protect rather than close the position because of my outlook for the market near term (a transition to the downside)...

Here's the BIDU Put position and profits there I want to protect without closing the position...this is the function of a hedge.

And as you see, a MUCH smaller QQQ Call position, the hedge, but already at a gain even in this market action.

Truth be told, these are positions that I'm 100% willing to lose completely, that's why they are speculative size.

Now as to the main reason, even though we don't have much in the averages, the VXX needs a larger reversal process, this is what I've been waiting for since last week, I've been patient waiting for certain events to start, they have, now VXX is building as it was expected to do, but it's not the size I expect.

HYG was the final straw, even though this is in a larger trend of distribution and has fallen out, it is probably the #1 most used manipulation lever and despite some deterioration, it's still with a divergence that is more than enough to get algos chasing stocks based only on HYG's price action. This may have been the cheapest way to run this mini-cycle, instead of accumulating in all of the averages and market Industry groups to get a move off, just accumulate in one asset that the algos follow as a move higher in HYG (High Yield Corp. Credit), which is almost exclusively traded by smart money, is seen as a risk on smart money sentiment and algos chase that, thus it's part of the SPY arbitrage, a known lever of manipulation.

Meanwhile VXX is still doing what we need it to do although it just started today which is fine as well.

I'm also going to try to show you the run of charts in the SPY as a few people have asked to see them, this current mini cycle identified Friday afternoon is NOTHING like the positive divergences leading to the February rally which we knew about long ahead of time and predicted it perfectly right up to the start of the rally when everything else in the market was as bearish as you get, again THERE IS NO COMPARISON BETWEEN THEN AND NOW, NOT EVEN CLOSE (we have 1-3 min positives now, we had 30 min positives back then over a period of 2 weeks, not 2-days).

First VXX and HYG...

VXX has begun accumulating, we look for this and call it a "Constructive pullback", it means it's the kind of pullback we want to buy because as prices pullback they are accumulated rather than in line which means prices are just dropping.

However, VXX is so much more important than the accumulation of a mini cycle as it already has huge accumulation, THIS IS MUCH MORE ABOUT TIMING THE MARKET THAN ANYTHING ELSE AND THAT'S WHAT WE CAME UP WITH FRIDAY AFTERNOON AS WELL.

5 MIN VXX leading positive so there never was any serious trouble here even in the very short term, you can see today it has added to the leading/flying divergence, but as I said earlier, the base or reversal process is too narrow, a few hours isn't enough, I expected at least a full day, so I drew in yellow arrows to give what I would expect to see as a minimum.

Remember though, VXX does not need the accumulation, it's already there, this is just short term timing for a longer term event.

For example...

The 60 min VXX and UVXY charts have enormous leading positive divergences.

VXX 60 min...so again it's not about accumulation, it's about a timing signal.

Even if you didn't have 3C, with the short squeeze on the market's Feb. rally, you should be able to tell if was a hollow move simply by comparing VXX to the market (SPY) as I have done below, remember that they usually trade almost mirror opposite of each other.

The SPY is in blue and VXX green, note the SPY climbing higher after the start around Feb 6/7th , but by the 18th (even before then, but here it is clear), VXX WILL NOT MOVE LOWER, INSTEAD IT IS TRENDING UP, telling you that there's a huge bid in VIX futures as protection because there's real concern among the pros, they know the short squeeze rally was impressive because of a short squeeze, not because of actual accumulation, in fact you'll see on the SPY charts (if you haven't already), that this move was used for distribution which is something we predicted BEFORE the move started, it's a means to an end.

As far as HYG, this is why I took the risk with the calls in IWM and QQQ, I have significant profits in market puts as well as some assets like BIDU and didn't want to close them, but still protect them, the hedge using these calls works perfectly and even if they fail and are worth zero, the gains in the IWM puts and others will far exceed the losses on the smaller call/hedge positions.

HYG 10 min which is about as far as the HYG positive goes, has a huge negative and by comparison, a smaller positive now, but it is still respectable, even if the averages themselves have no where near this kind of divergence.

Here on HYG's 1 min chart you see the concept of, "New divergences start on the earliest timeframes", the positive above is seeing deterioration and it is showing up on the earliest or fastest timeframe first. You can also see why this was part of Friday's analysis for this week as we could identify a positive forming as early as late Friday afternoon, also note the head fake move, you don't usually think of it as that, but that's a stop run.

As far as the best we have in market divergences, probably the Q's and IWM, although I'll show the SPY too, just in it's own group of multiple timeframes.

QQQ

This 1 min positive is not big, this is today only, intraday!

This QQQ 2 min positive is just about as big as it gets, but note the leading negative action that drew price lower earlier today, that should tell you something about how weak this market actually is.

IWM-probably the best divergences are here... (positive)

Again the 1 min or intraday is not impressive at all.

The 2 min IWM has been leading negative in 3C and price has been following, however, note that we can see a positive divegrence late Friday afternoon, this is why I was spending so much time looking for the divergence after the market options expiration max pain pin was over after 2 pm on Friday, to see where the market would pick up this week and what the most probable course was.

You can see the divegrence has built since then, it is a relative positive which is the weaker form and it is within a larger leading negative which is not only the stronger form, but also much bigger, however it is this exact dynamic and multiple timeframe analysis that creates bounces within a trend which is essential information to have for trading trends.

Now the IWM 5 min shows just HOW WEAK THE MARKET IS AND HOW SMALL THIS MINI-CYCLE IS, IT CAN'T EVEN REACH THE 5 MIN CHART AND THIS IS WHY HEDGING POSITIONS WERE SO SMALL.

As for the SPY's short term and multiple timeframe trends as I promised...

Again the SPY 1 min at the time of capture about 30 mins ago, not impressive by any means.

The SPY 2 min, nothing positive at all anymore, it was the worst since Friday any way, in fact there's more of a negative/bearish short term case made if you look at the SPY alone, but we never look at 1 asset alone, we look at as many things as we can and find probabilities.

The SPY 3 min chart shows the accumulation that we saw the Monday BEFORE Putin's peace overtures that sent the market gapping higher, since then though, look at the 3C action and the fact it is in a flat range is important as we see divergences VERY often in flat ranges, I think it has to do with filling orders at an average price like VWAP.

As you can see, there's NOTHING in the short term SPY that is positive or useful , HYG is much more useful.

There are however somethings in QQQ and especially IWM, which is why I opened the calls in those two assets.

At 10 mins SPY is leading negative.

15 min SPY, nothing resembling accumulation at all.

The 30 min SPY shows the Feb. rally to the right, look at the distribution in 3C, this is what I expected and posted BEFORE the rally even started, before anyone else knew a rally was coming and this is the confirmation I needed to see to validate my trend analysis, in other words that this rally wasn't an end, but the means to an end, setting up the next trend down which is larger and more important.

The 60 min chart shows the accumulation that told us there was a rally coming, we even called the 2% drop or head fake move that comes right after the 1 week range of accumulation in the white box to the far left. Then we confirmed the head fake as price moved lower and we saw accumulation (the second white box or one to the right, this is how we were able to not only predict the rally in advance, but that it would be VERY strong, however the overall position of 3C told us that it was being used to facilitate the start of a larger downtrend just as the head fake move lower in early Feb. told us that it would be used to make the rally happen as it set a bear trap that caused panic and short covering.

This is the ,multi-hour chart, this tells us the long term probabilities and that any rally higher that we expect is not going to be a bull trend, but part of a trap as this is the higher probability and a VERY clear one at that, leading negative 4 HOUR!!!

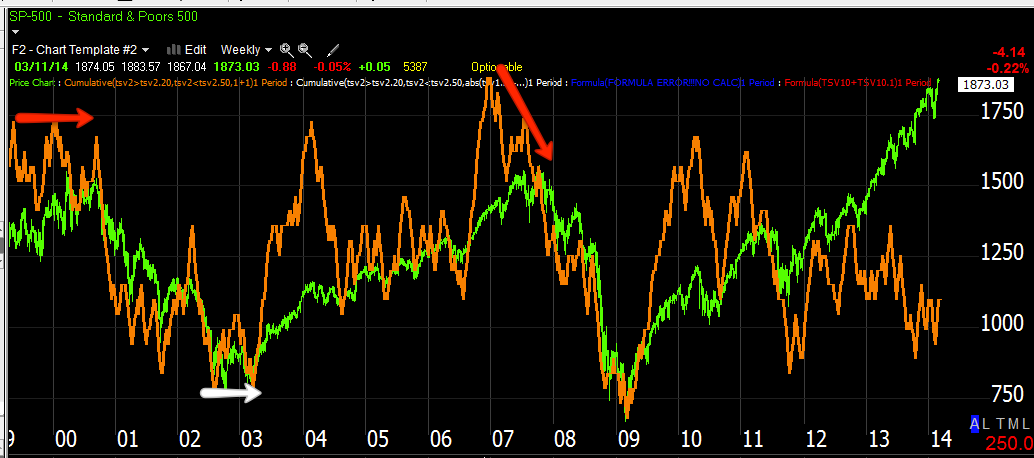

What's worse and tells us the most, the 5-day SPY chart, you can see the negative divegrence at the top of the 2000 Dot.com bubble, accumulation at the 2002/2003 lows, distribution at the 2007 top and the current distribution is worse than anything we have seen. no where else on this chart do you see price naked without 3C confirmation, the leading negative here is the most insane I've ever seen.

Do you remember my chart of the Dow now vs. 1929? It is FAR WORSE NOW.

No comments:

Post a Comment