Here are the divergences in the averages and the Index futures, you will notice they still have not become any stronger than they were when first spotted Friday and they don't even have the ability to have gathered strength through duration as they had no positives yesterday and have seen almost as much intraday distribution as accumulation, in other words the time factor of how large the accrual of a divergence is , is not even a concept in play here.

Even the Yen is showing late day distribution after a larger accumulation cycle, so this makes sense on this 1 min timeframe with the signals in the averages and most index futures.

Nothing has changed since Friday afternoon except maybe the timing which is something I said I didn't want to get in to other than to say "Early" this week".

Earlier Yen accumulation which send the carry pairs lower when the Yen reacts to the accumulation and moves up as it did on this 1 min chart, that sends the market averages down. The negative divergence right now is not a serious event as the 15, 30 and 60 min charts gain even more strength, but it does confirm the short term signals below and EVERYTHING we have been looking for and specifically called out for this week late Friday afternoon. You'll see that by the small positives and the much larger negatives.

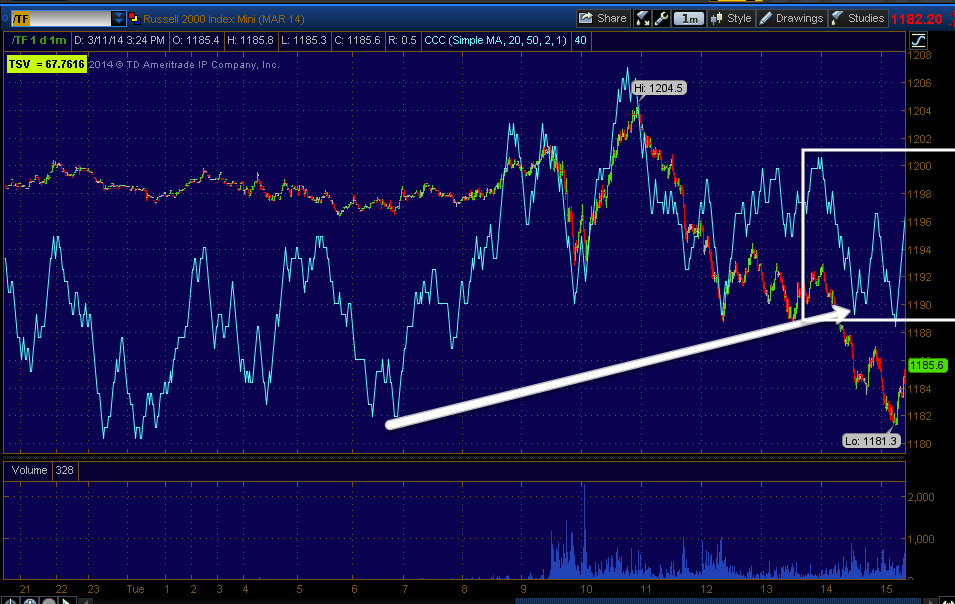

Index futures.

ES hasn't done much, but the SPY has.

1 min NQ or NASDAQ 100 has a 1 min positive intraday.

So does TF or Russell 2000 futures.

These will not hold overnight so if they don't fire off before the close they are a moot point, the same is not true of the averages below, trade will pick up where it left off on a 3C divegrence the next day most of the time.

The averages...

A small SPY 2 min positive has formed here.

However as I have been saying in this rather odd mini cycle that shows NO MIGRATION of the positive, there's NOTHING ON THE 3 MIN CHART EXCEPT NEGATIVE SIGNALS.

This fits EXACTLY with Friday's late day analysis for this week.

The IWM 2 min has a "RELATIVE positive, this is the weakest form, but it's there.

The divergence that has always means the most for the averages is the IWM 3 min relative positive above.

However, at 5 mins. AGAIN NO MIGRATION AND IN FACT A LEADING NEGATIVE DIVERGENCE.

This is just more confirmation of how weak these signals are, they should still do their job, but they are exceedingly weak, to not be able to migrate to 3 or 5 min charts in almost 2 days at ALL is something I rarely see.

QQQ 1 min is positive as you see in to late day washout, possible head fake low.

The QQQ 2 min is also positive in to recent lows...

However at 3 mins, other than seeing a possible stop run head fake move, EVERYTHING about this chart is negative.

AGAIN, WE ARE RIGHT ON TRACK AS FAR AS MARKET SIGNALS, THE WHOLE POINT IS THE TIMING, NOT THE MOVE.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment