Considering what the VXX looks like (this is a VXX update from Wednesday April 29th) and the probable head fake move put in today, taken with these charts, I think the information that I gather the last two hours of Friday is pointing very clearly to a significant move to the downside in the market.

I said if I had a chance I'd put up some charts, here are some charts of the averages, I'm also looking at potential trades in several different assets, I like VXX or UVXY long a lot and there are several (actually many) others, but in most there's 1 nagging chart I'd like to see resolve.

In any case, if you look at the VXX signal trends and these, I think you'll agree, we are on the edge of a significant move down, not the noisy , volatile chop that has dominated for about 2 weeks now, but a real move that makes a lower low in an index like the NASDAQ 100 (I mention that one specifically because it had retraced the most (all of the Feb. rally).

DIA 1 min

DIA 2 min

DIA 5 min

DIA 15 min, this is the killer that's screaming new lower low.

IWM 1 min intraday

IWM 2 min

IWM 3 min

QQQ 1 min

QQQ 2 min, that's a lot of movement even for these faster charts.

QQQ 3 min trend

QQQ 10 min

SPY 1 min. -you see what I mean, this looks like it's ready to fall off a cliff timing wise.

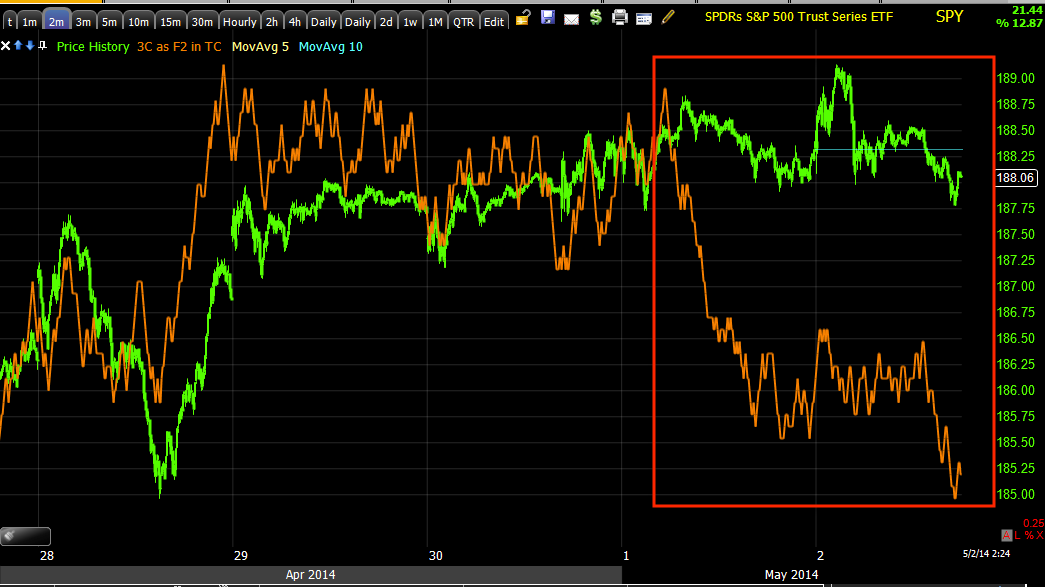

SPY 2 min, another great example.

SPY 5 min

I'll be adding more as it comes up, I'm really trying to decide whether positions here are appropriate or a day more...the op-ex doesn't help

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment