While I'm not a huge fan of early trade as there tends to be a lot of game playing with limit orders and stops early in the day, there are some interesting events such as the continued plunge in European yields, the periphery or PIIGS nations (Portugal, Ireland, Italy, Greece, Spain) is understandable considering the spin on Draghi's comments, banks would be eager to front run a possible QE operation by soaking up the very bonds the ECB would intend to buy, but with the German 5 year going negative this morning for the first time ever at -1bps, even lower than the Japanese 5 year at +3 bps, that seems more like a flight to safety.

Additionally, it would "seem" bad news is bad news which is a change as US ISM manufacturing and Construction spending hit 6 month lows this morning, with the former's New Orders sub-index cratering.

This is the USD/JPY (candlesticks) vs ES (purple) this morning after the cash open (green arrow).

There's a bout of some Yen strength since the open, not huge, but a reversal since the open of the trend since new trade in futures opened.

The $USDX has made a relatively small move so I suspect most of the USD/JPY movement is due to the Yen which is what we saw earlier in the week as well until the $USD caught down and really moved the pair lower Wednesday.

Interestingly the short term VIX futures have rallied from the gap lower with a slight negative divegrence at Wednesday's close suggesting a gap down on the next day of trade, but shortly after a positive divegrence in to the lows on a 1 min chart and in line as it moves higher.

This isn't a screaming signal on its own, but it does look like a bid toward protection.

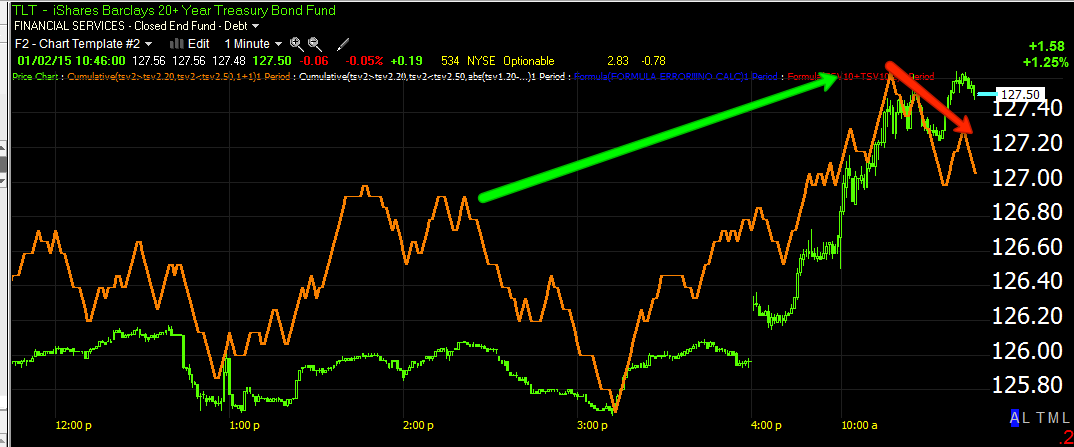

The 30 year Treasury futures are also showing a similar bid to safety with an intraday positive divegrence and a ramp higher right at the cash open.

This can be seen in TLT as well which never really fell out of line as it moves higher this morning, but is starting to develop what may become a more interesting negative divegrence, at this point it's just noise.

What is really interesting is the NYSE TICK index, note the downtrend since the open and hitting some pretty deep levels showing there's some serious selling early on here.

The SPY looks to be in line this morning on it's initial move lower.

The Q's had the best looking 3C underlying action of all the averages with a positive in to the close Wednesday which fulfilled on the gap up, but didn't last any longer than that, now moving in line to the downside.

And the IWM which had a leading negative divegrence at the close Wednesday gapped up, lost the gains quickly and is in line with 3C moving lower.

As I'd always warn this early, "It's very early in the day", but considering the "January Effect" and TICK, there's some real selling going on here.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment