As posted first thing this morning in the A.m. Brief, the expectations of both "Week Ahead" posts as well as the Daily Wrap Friday, in addition to numerous other reasons, ended the post with the following which is one good reason in my view to take the time to learn about the lost art of "Volume Analysis"...

"Interestingly for next week , especially the early part, Today's Dominant P/V RElationship was SUPER Dominant across the board: 27 Dow stocks, 91 NASDAQ 100, 1141 Russell 2000 and 327 SPX 500, ALL CLOSE DOWN/VOLUME UP.

This is obviously a very bearish relationship, but it's also a strong 1-day oversold relationship and most commonly we see a short term oversold bounce the next day or so.

Of the 9 S&P sectors, ALL NINE WERE RED. Utilities were the best performer at -0.36% and Consumer Discretionary lagged at -1.48%.Of the 238 Morningstar groups, 226 were red.

Only 11 Dow stocks remain above their 50-day moving average, only 1010 (almost half) of the Russell 2000 are above their 50-day.

Overall, the market is at a deep 1-day oversold point so our forward looking analysis for early next week doesn't look so far off, a 1-day oversold bounce and INCREASED VOLATILITY sounds very reasonable here, that should be an excellent entry for positions, options/puts, etc."

As seen earlier today in Remember Volatility? the recent swings and ranges on a daily basis have seen the increase in volatility we have been looking for, even if price essentially remains flat on the year which in itself is a message of the market. As noted numerous times, I can't remember how many times I have posted that an average was green YTD or red YTD as they keep flopping back and forth, not at all the trend of the last 5+ years.

Friday after the Chinese markets closed, futures sank as low as -6%, the overnight PBoC RRR 100 basis point cut (18.5%) was the largest RRR cut by the People's Bank of China since 2008 and wreaked of panic. Furthermore, clarifications by market regulators were made to make clear they weren't trying to pop the bubble in Chinese stocks, as I said this morning in the A.m. Brief .

And why shouldn't they wreak of panic? I found this image of Chinese stock traders most amusing and most terrifying.

No Joke!

While the Shanghai Composite pared back some of those futures losses, not even a 100 basis point RRR cut (easing) from the central bank could close the Shanghai Comp green at a -1.64% loss. Note the Ultimate Oscillator divergence which is quite large, but even more impressive as we go down the list...

The Hang Seng which saw a parabolic move as regulations changed to allow more investment in the Index that sells the same stocks as Shanghai, but they were at significant discounts of up to -35% in some cases.

Now the candlestick price pattern looks like a classic TOWER TOP! And with the Ultimate Oscillator divergent too on a parabolic move which I never trust anyway.

Take a look at Germany's DAX, if that doesn't look like a top with the U.O divergence, I'm not sure what does...well the Hang Seng may win the prize, all of which we saw well over a week ago in FXI posts/updates.

Remember the LEADING quality to the $USD lately in posts I have put up numerous times, which with 4-days down last week was the worst 4-day performance in just about a year, saw a bounce today, again with a leading indication for the broad market, take a look at $USDX futures on a 3C chart.

You may recall the April 2nd $USD forecast for a bounce and then a larger move down, one that may put the $USDX in a primary downtrend as it has made a lower high, next a lower low will be a significant change and put significant pressure on the $9 trillion in $USD-based carry trades, which will in return put significant pressure on risk assets like stocks as Carry trade losses snowball at 100-300x leverage.

The positive divegrence on this 10 min chart of $USDX led to today's positive performance, but note the negative divegrence in to today's gains.

This on the back of EUR weakness (also a former carry trade currency) and $AUD came under pressure after first rising on the PBoC RRR cut, then being talked down by Stephens (another former carry trade favorite currency) who said he wouldn't be surprised to see the $AUD head lower.

Considering the $USD's recent leading of the SPX (consider the forecast for the $USDX-Larger leg down since the bounce was completed), last week's late in the week negative divegrence in the EUR which led to a move lower, forecasts $USD strength as EUR weakness typically translates in to $USD strength, thus another signal from last week of today's oversold bounce (based on market breadth/internals, NOT INDICATORS which can stay at extreme levels for a long time). Thus today's $USD distribution in to the bounce is a negative sign for the stock market following the same logic and relationships that have been in place.

SPX (green) vs. USD (red) and the leading relationship of the $USD.

Today's $USD strength seemed to weigh on the precious metals with GLD-.76% (as we have been recently looking for) and SV down 1.74%. I'll be updating GLD tomorrow.

As for the averages today and their forecasted oversold bounce condition after last week's Chinese margin crackdown, expanded Chinese short salable stocks, Greek Exit headlines and the Comcast/TWC antitrust headlines internals showed the market was due for an oversold bounce which is much more reliable than indicators that seek to prove the same. Tech was the leader with AAPL up over 2% finally making its move above its triangle's apex and on the watchlist, Tech was just behind transports actually, which deserve a bounce.

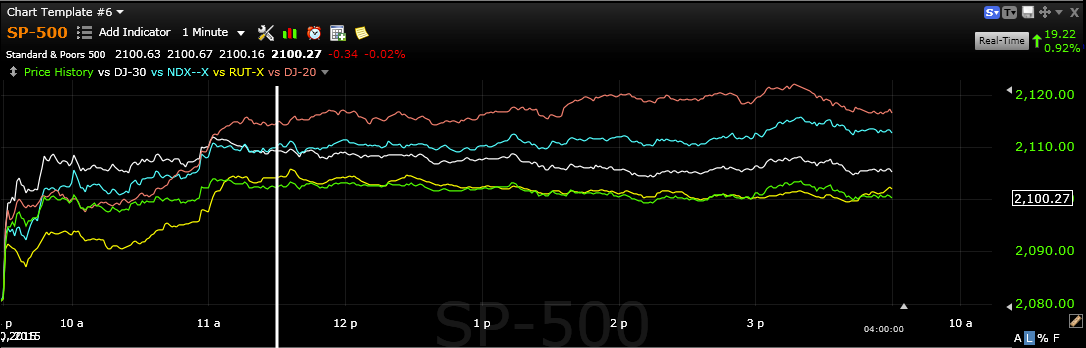

The major averages with the NDX in blue at a gain of +1.51% and Transports in salmon with a gain of +1.69% despite oil prices, but you know what I believe we will be seeing near term in USO/oil. Saudi oil production is at a NEW RECORD high.

I'll be updating transports tomorrow as well looking for another entry for those interested as Transports have been a core short position with at least 2 previous entries.

Note after the European close, the averages went flat on the day.

As for the "Reversal Process" forecasted for last week, looking at the major averages over a week's time, you can see the flat reversal process as there's virtually no movement from the start to the end of the week period covering mostly last week.

Energy over the last week (blue) has led, but as you know, I believe we will see USO weakness and Energy in general (XLE) is another asset I should be covering tomorrow, even though it's much broader than simply the price of oil.

XLF you likely already saw in an earlier post, it's also high on my list.

Yields were modestly helpful to the market today as might be expected

Internals...

Ironically in almost perfect opposition to Friday's oversold condition in P/V relationships and sector performance, today was near the EXACT opposite.

The Dominant Price/Volume Relationship once again hit extremes in all 4 major averages, but unlike Friday's solidly near term (1-day) oversold, today was the most bearish of the 4 relationships, Price Up /Volume Down. There were 21 Dow stocks, 82 of the NDX 100! 1018 of the Russell 2000 and a walloping 316 of the SPX 500 (of 4 possible relationships), this is extremely dominant.

While I'd normally say this is a 1-day overbought condition, it can also be interpreted as a VERY weak upside move that is failing, we still have that SPX trendline head fake area just above around $2115 which would make for an excellent set of trade set ups as mentioned in Friday's Daily Wrap, especially put positions.

Adding to the argument for a 1-day overbought condition, all 9 of 9 S&P sectors closed green with Tech leading at +1.71% and Consumer Staples lagging at +.35%.

Also a huge 208 of 238 Morningstar groups closed green. If this is not a 1-day overbought event with a red close tomorrow, it is CERTAINLY a VERY weak trend on any further gains which would suit me just fine if we were to make a head fake move in the SPX!

The overall 3C charts look horrible on this move with no confirmation and steady migration in the intraday timeframes to leading negative, but tI suspect there's a little room for some additional upside.

Ex:

Not even a 2 min chart could confirm today's oversold bounce! This is not good for the overall market moving forward.

The 3 min looks similar

The 5 min looks perfect for a reversal process and remember, the 15 min chart was the line in the sand...

Since the 4/2 bounce/triangle forecast, 15 min 3C/SPY was in line perfectly then went negative, now leading negative EXACTLY WHAT I WAS LOOKING FOR AND DEPICTING SEVERE WEAKNESS IN THE AVERAGES.

Our leading indicators are looking great as well. The SPX:RUT ratio is severely negative. Pro sentiment indicators are severely leading negative, yields are leading negative, HYG is falling apart as it was notably weak intraday, commodities are taking a turn to the downside and HY Credit has done so already since the reversal process of last week seen above on the week long comp. of the major averages.

I'll take another look at Index futures before turning in, but so far there's nothing special about ES or TF, more or less in line, but NQ/NASDAQ 100 futures are showing some intraday 1 min weakness...

NASDAQ/NQ futures pop on the US open and note the distribution in futures all day, but especially in to the flat area (think VWAP) after the European close (shown above).

I COULD NOT BE HAPPIER WITH THE WAY SIGNALS ARE GOING, THE WAY THE FORECAST HAS PLAYED OUT.

IF WE CAN GET THE SAME KIND OF ACCURACY AND SIGNALS IN THE TRADE ASSETS ON THE WATCHLIST, SEVERAL MENTIONED TONIGHT (GLD, USO, Transports, Tech, AAPL, Financials, Energy), I'LL BE TICKLED PINK!

Again, I'll check the futures before turning in, have a FANTASTIC NIGHT. I hope you can feel the excitement I'm feeling through the post and thank you for all the kind comments/emails re: Friday's Shout Out to Andrea, even if I didn't have time to properly respond (I hate perfunctory responses), know that I read them all and shared many with Andrea. We are so grateful for such an amazing group of people!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment