"I did consider opening a hedging VXX put for the VXX and UVXY longer term trend long positions, but I can't find enough decent evidence on the charts to justify it. There are some charts, especially futures that point toward the kind of bounce I thought we'd get this week, the kind of bounce that fulfills last week's The Week Ahead, but again there's very little evidence for that either unless the market does some serious work next week.

SPY 1 min intraday looks worse than yesterday. This does NOT look like it can support much if any bounce in to next week, so as I said, unless there's some additional short term base work put in, this market is looking dangerously close the the edge of the cliff.

...if anything I'd expect early weakness early next week...Again, unless there's some MAJOR work done early in the week, I think we'll be just taking what we can from the watch list of assets that are setting up on their own with no market support.

It's really not these charts that are as bad as they look, it's the HY Credit that's really screaming Bloody Murder for this market."

Honestly, I think that was a pretty accurate description of the kind of market action we saw today that landed the SPX below its 100-day moving average which has been key to the SPX...

SPX daily chart below the 100-day ma on the close and at the lows of the day.For the year to date, Transports are the worst performer (salmon) down -8.39%, but today the Dow-30 went red YTD as well (white), the SPX isn't far behind.

Intraday today the worst performer by far was transports with the NASDAQ 100 the second worst performer on the day.

As a reminder, the red flag of Dow theory with Transports FAR from confirming industrials and industrials going red YTD today.

It seemed to me that the day was not only seeing selling based on the indicators and simple price action, but on VWAP itself...

ES 1 min / VWAP during the cash market with several pushes to VWAP where middle men would have been looking to sell.

The $USD as we expected, after a 1-day bounce we had signals for Thursday which saw them fulfilled on the Payrolls data Friday, turned lower today as expected.

The $USDX daily chart since our 4/2 forecast for the $USD calling for a bounce (#1), followed by a larger trend to the downside (#2) and then we saw a counter trend rally coming with the strongest 7-day run in the $USD in over 7 years (#3). Today you can see the daily candle with a sharp, strong downside reversal. I expect the $USD's primary downtrend will see a lower low.

This may help our very short term, speculative USO long position from Friday, Trade Idea: USO (Speculative).

This stronger 10 (and 15 min) $USO chart show the current negative divergence that should send it lower and then we'll look at a longer term trend long position.

GLD 15 min positive divergence. It seems to me that it just needs a little more reversal process, otherwise it looks pretty close.

I believe a TLT long entry for a strong counter trend bounce is also nearby...

TLT intraday filling out what looks like a nice reversal process/base area.

3 min TLT looks even better.

Don't forget that these counter trend rallies tend to be the strongest rally you'll see in any market, bull or bear. I'll be looking to pinpoint an entry there likely tomorrow.

As for commodities, you have to go back to the $USD and Yen charts, it looks like the carry trade unwind is back inform which would make sense given stocks' performance.

Commodities (brown) tracking with the SPX (green) while the $USD's counter trend bounce and reversal were on, with the $USD moving back down, commodities are up which is natural, but also a sign of the $USD carry unwind.

As for leading indicators, I said last week and today that the market needs to do some work before I'd trust anything on the long side for either a speculative trade or even for a bounce to short in to, we didn't quite get there today as pointed out here, Market Management

However, while not screaming for any such move, there are hints that the market may try to get a small base area for a little bounce in place.

Here's a larger Leading Indicator view of the same, something has obviously changed for the worse.

And our second confirming version.

However as I often say, the first market manipulation asset used to ramp the market or support it is HYG.

Today HYG's price ROC declined and flattened out.

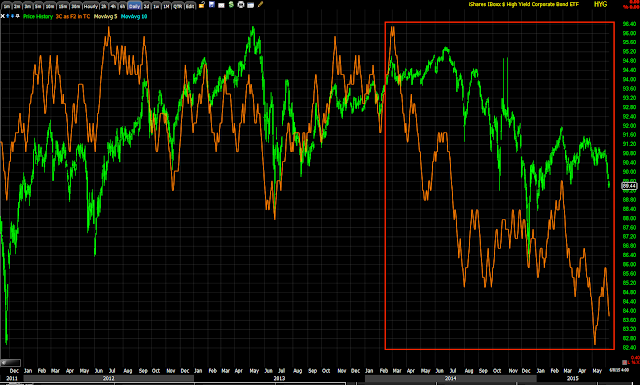

The intermediate term is in horrible shape and I wouldn't make any argument for the market beyond a bounce of the oversold type at support, this chart tells us that clearly...

The longer term HYG vs SPX shows where Institutional risk on was leading at #1, where it was in line at #2 and where it went to risk off at #3. Again, I wouldn't make any argument for the market beyond a bounce off support and it still has a bit of proving itself to even get that far.

However before HYG's price diverges with the SPX's, we get an early heads up from the 3C charts and this 2 min intraday HYG 3C chart shows a positive divergence short term.

As does this 5 min chart.

I probably don't have to say it, but for purposes of demonstration...

The most important/strongest daily 3C chart of HYG argues for nothing but a bear market in equities.

As fr internals tonight, there was no real Dominant Price/Volume Relationship. The only 2 averages to get close were The Russell 2000 and the SPX and both were Close Down/Volume Down, the least influential relationship of the 4. However interestingly there were only 8 Dow stocks > their 50-day, 38n NDX 100 stocks, 874 Russell 2000 stocks and 169 SPX-500 stocks, breadth is clearly very questionable.

Of the S&P sectors they looked a lot more like a 1-day oversold condition with 9 of 9 red with Tech lagging at -1.12% and Consumer Staples leading at -0.04%.

Of the 238 Morningstar groups 212 of 238 closed red. This looks like a 1-day oversold condition, if the Dominant P/V showed the same, I'd say we'll bounce tomorrow, instead I suspect we may build out the reversal area for a small bounce, the "Work" I said the market needed to do last Friday if it has any chance of seeing any upside which we can use for entering short positions as NFLX and Transports are bellwethers for the others and unlike Friday as they diverged a bit wit the market, today they couldn't withstand the gravitational pull. They'll need the market as I originally thought to get anywhere near a better entry with much lower risk and better timing, although since the head fake above the SPX's ascending triangle, it seems to me our April 2nd forecast is coming true rather accurately.

As for futures tonight, I was surprised today how in line most futures were and this is not just under futures, but everything from currencies to bonds, VIX futures, Treasuries, etc. I suspect tomorrow will shake things up a bit more and create 3C movement that creates opportunity.

The NASDAQ futures look a bit better.

TF is in line like ES.

However, I don't see HYG accumulation , even very small scale as we see above, being carried out for any reason other than short term market manipulation/support, so I'm guessing any new shorts on the break of the SPX's 100-day are about to be kicked out of the trade which hopefully will give us the room we need to enter the trades we have been patiently waiting for to set up- they haven't fallen apart (like NFLXX), they just need that extra little boost to reduce risk and give us the best entry and timing.

I believe HYG is the asset the crowd missed, at least the 3C chart, we'll see tomorrow and we'll see about USO, gold and TLT/Treasuries which I think will all present opportunities tomorrow.

No comments:

Post a Comment