The EUR/USD pair fell pretty much all night, typically not good for risk, but we can't forget today is an op-ex day so the pin will likely be in, yes, even on the weeklies now.

The USD/JPY carry pair also fell quite severely after coming within .50 of Kuroda's $100 target.

However there are some opening positive divergences forming there.

The real culprit behind both risk pairs falling and sending futures lower overnight may indeed be their partners, the $USD...

USDX 1 min gaining ground

And the longer term USDX 4 hour chart (each bar=4 hours) had pulled back in yellow from its uptrend, it appears that pullback is now over.

The overnight result anyway...

Here's NQ first because last night I looked at every timeframe here, 1m, 5m, 15m, 30m, 60m, 4hr and 1-day, all leading negative. I don't recall ever seeing that ll the way through and the longer the timeframe, the stronger the signal, if a 5 min negative can move the market on a short swing, imagine what a 30, 60 or 4 hour can do.

NQ 5 min

NQ 60 min- all leading negative badly, but there is a pre-market 1 min positive in NQ.

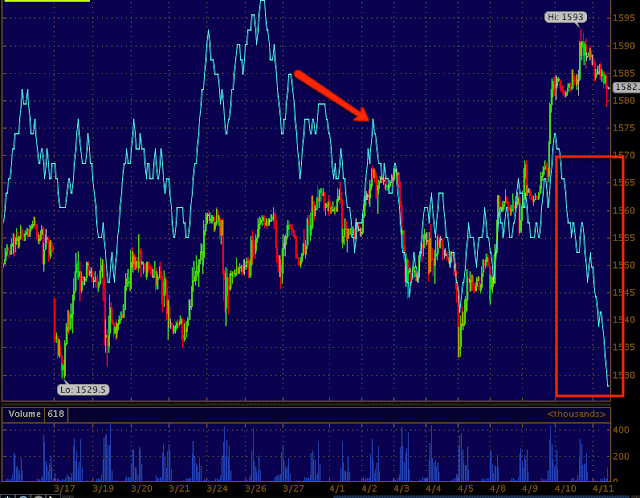

ES 1 min, the green area is yesterday's close at 4 pm is in line this am

Here's the ES 60 min chart, look how sharp and deep that leading negative divergence is and on a 60 min chart.

TF 1 min (green is the close at 4 pm) with a positive divergence in to the open.

Here's a 15 min chart example in the R2K futures, leading negative badly, these are all over the place.

I say, "When 3C charts jump off the page, don't ignore them" These are the charts I don't ignore.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment