First off, I'm looking at a lot of charts and seeing a lot of confirmation, in VIX or its derivatives, Safe haven Treasuries, in the averages themselves, there has been some serious damage done on the way up and it's being felt now and this is just the start.

Remember we do have options expiration tomorrow so look for the max pain pin, typically somewhere near Thursday's (today's) close, at least until about 2 p.m.

In any case, we entered a TLT long, but used its inverse ETF, TBT (2x short 20+ year treasuries) to get some leverage on the TLT long as the leveraged long 20+ year ETFs have very poor volume.

It was just this morning I posted the 30 min charts of the 5 , 10 and 30 year Treasury futures, Futures Update, and their positive divergences, it didn't take long for them to make some solid gains today.

30 year gains since about 8 a.m. this morning...

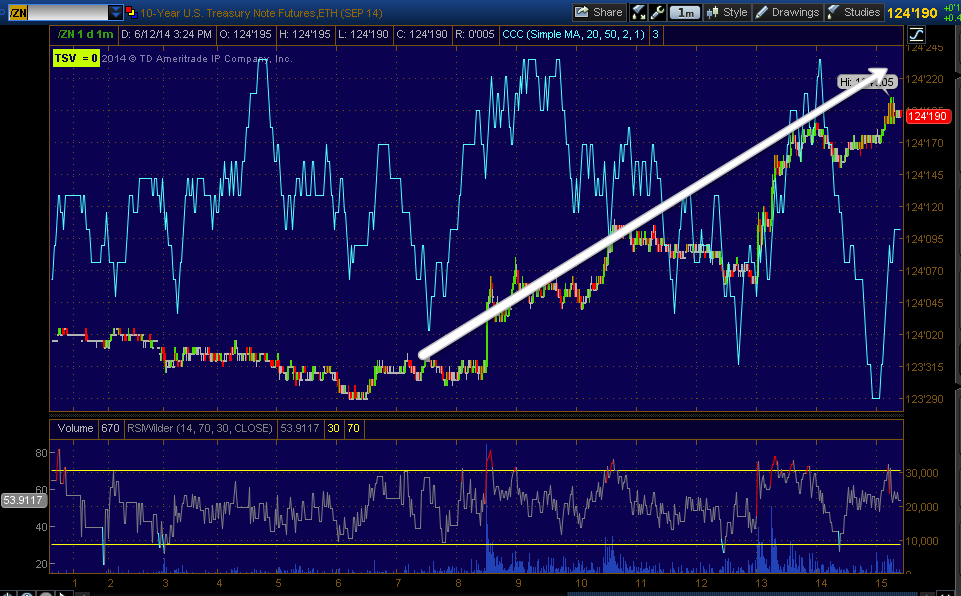

10 year Treasury futures gains since this morning.

And the 5 year gains since this morning.

As far as the TLT long which we used TBT short to get the leverage with decent volume, Treasuries / TLT Trade and TBT Reiteration (short) / TLT (long) , the idea was this...

TLT had fallen out of its channel, a Channel Buster, typically these make sharp moves to the top of the channel and above before falling, so it's that move up we are looking to play and we'll see what TLT looks like at that point.

Today was the first serious move in that direction after about a week of small stars and dojis forming a reversal process.

As for TLT intraday, it has been leading positive making it an interesting trade, but it needed some leverage to make it worthwhile, thus the TBT short.

The 5 min chart leading positive and today is the first day responding to 3C's forecast of higher prices.

And a leading 15 min chart so this should be a decent swing+ move.

As for TBT, the actual asset we are short, here's the short term 2 min going leading negative and price responding to 3C's forecast.

And the larger 15 min leading negative, confirming TLT's leading positive.

I think we have a great looking trade here and rising yields should pressure the market lower.

If there's a slight pullback within the next day or so, as long as you can enter around the lower trendline of TLT's channel, I think you still have a decent entry.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment