First lets look at the long term or strategic view, then we'll look at the tactical set up.

At first look, JAZZ looks pretty strong, there are some RSI divergences, one very recent followed by a breakaway gap on heavy volume. It would seem that something is changing in JAZZ, but it is a bit difficult to define from this chart alone.

Add a linear regression channel and it becomes more clear. JAZZ early in the trend was moving in the top half of the LN channel, strength. After the first break of the channel, JAZZ never recovered that same momentum and was stuck in the lower channel until the most recent break.

The daily 3C chart tells the same story, nice powerful positive divergences early on in the trend, through late 2011 and 2012, the divergence is leading negative.

A closer look at the daily chart, JAZZ broke down hard on a high volume gap, since it has filled the gap so the gap is not a likely target. We also have a bear flag in April, actually a bear pennant as the consolidation is a triangle, volume confirms this. TA traders are looking for the pennant to break to the downside and continue the bear flag's implied trend. I don't argue with the bearishness of the bear flag, I argue with the break of the pennant, I believe it breaks up and shakes out the shorts before continuing down, so if we can short JAZZ in to the strength of the upside break, we have a pretty decent position.

JAZZ 60 min 3C confirms weakness in the area of the most recent top formation with a leading negative divergence.

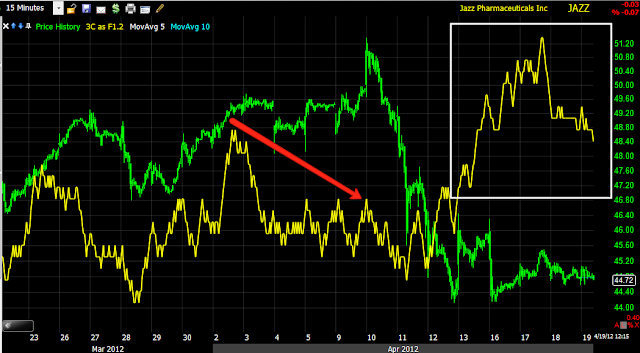

The shorter 15 min chart shows a positive leading divergence right at the bear pennant, suggesting the expected break to the downside, will actually break to the upside first, shaking out shorts and giving us a nice entry on price strength to short JAZZ.

This is a VERY volatile stock and Biotechs are not always my favorites, you may want to check if they have anything in the pipeline coming up for FDA review, but based on the 3C charts, as we just saw with HGSI, it doesn't appear that way. Since JAZZ is so volatile, I have a 5 day trend Channel stop on it, that puts the stop near $50, hopefully JAZZ can break out to the upside and lessen that risk , $46, $47 or something like that would make the trade a lot more appealing.

If you like JAZZ, I would set some price alerts to let you know if it is moving in our desired direction.

No comments:

Post a Comment