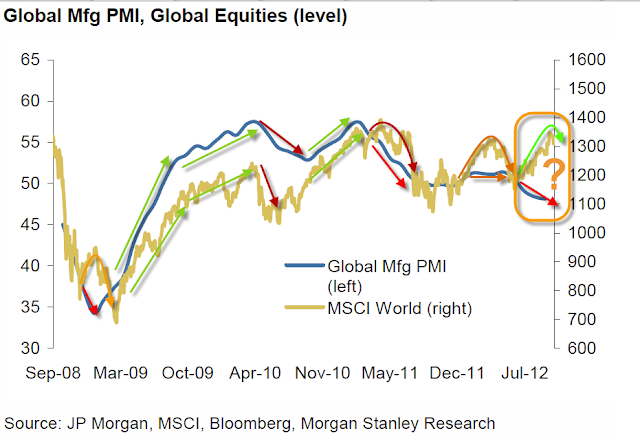

I found this chart pretty interesting, in blue we have the Global Manufacturing PMI composite vs the MSCI World Stock Composite.

Note that when manufacturing turns down, the market isn't far behind. In 2010 the market turned down about the same time, but QE1 was ending with no follow on program announced, also in 2010 the market turned up before manufacturing, but again, Bernie had announced the QE2 intent at Jackson Hole sending the market higher. In 2011 the end of QE2 was known in advance, manufacturing seems to have led the market lower here as we saw that 20% decline in late July 2011, manufacturing is again turning down and divergent with the market.

This is where I do have some thoughts that have been mentioned before...

First of all, "QE-3 is there to help employment" in my view is political cover and not very good at that; QE has never been shown to lower the unemployment rate, if it had we'd have heard about it non-stop from Bernie and we wouldn't be engaged in QE3. The fact is, weeks after QE3 was announced, as I suspected, a bunch of bad economic news came out, manufacturing was worse, Q2 GDP was revised even lower, Q3 GDP has been revised lower by GS 2 times in 2 days in the last week.

I can't even say that I believe QE3 is there to help manufacturing, think about it...

All of the manufacturing reports except the last one that was way out of left field and completely contradicted not only nearly a year's worth of data, but even a report released a day earlier, all have the same themes around the world:

Inventories are up because they aren't shipping as much (see the transports), new orders are in contraction, exports are in contraction, employment is down because capacity utilization is down and the one that stands out the most... Input costs are rising= inflation or to be more specific, STAGFLATION!

Before producers hire employees, they have to burn through current high inventories, they have to start using the spare capacity that is sitting idle and push it to the max until they can't push it anymore without more employees.

For that to happen, consumers need to consume and with the latest Consumer Spending rising due to one thing and one thing only, higher gasoline costs combined with higher food inflation, consumers are feeling the pinch as well.

The one thing we know QE does for sure is debases the value of the dollar or causes price inflation, so with consumers paying even more, savings worth even less and manufacturers input costs rising even more, where exactly is this demand going to come from that will spur new hiring?

Lets be honest, there's only a few places that really benefit from virtually free money by the tens of billions and that's the banks. It is my opinion that the first round of QE was a way to give the banks money without having to directly bail them out which was politically very unpopular, during QE2 the banks were raking in the money.

If there is a bigger problem that we are not aware of that caused Bernie to, as ex-F_E_D governor Kevin Warsh described QE3, "Panic when the economy isn't in a panic", then the next surprise may very well come from the financial sector. Remember how quickly Bear Stearns and Lehman happened, or MF Global for that matter.

In any case, manufacturing is more of an economic outlook indicator than even transports and both right now are not looking very good at all. I just wonder how the Financial sector that feeds off the economy is really doing because I believe that's the reason QE3 popped up.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment