I think they will, but as I said, this isn't a well thought out EU plan like all the others and once we got past the headlines of a deal reached, the details and ramifications are causing a lot of panic.

European Financials saw their worst 1 week drop in 8 months, what does that tell you since the first plan to steal people's money was announced a week ago? No bank in the EU is safe and they are suffering for it.

In Italy the banking system went limit down as credit spreads hit 4 month wides! The European equity indexes saw their biggest drop since the Italian elections a month ago, Switzerland's SMI market was the best performer as Swiss 2 year rates are still zero. The Russian Rubble, it is having it's best day in 6 weeks vs the Euro.

What's all of this telling you about this deal?

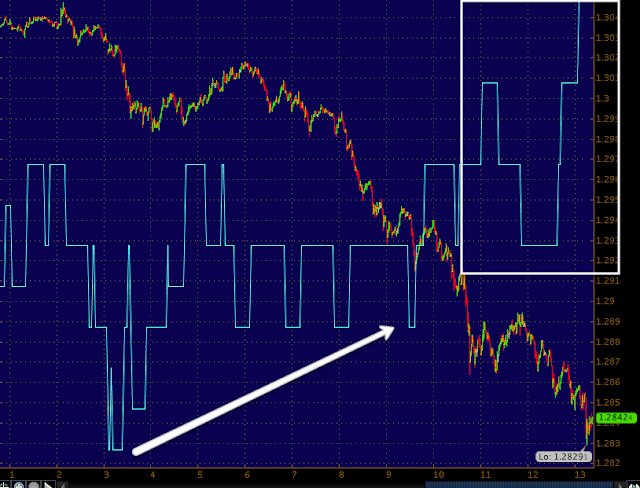

In any case, the EUR/USD knows something the equity market doesn't know yet, they are pulling the nose up, I'll post more charts in a minute..

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment