Again this isn't a victory lap because there are a lot of times the rank doesn't look so hot, but the idea is to be selling puts in to higher prices or buying calls in to lower prices and then close them on the reversal, the entire concept is really summed up as "Let the trade come to you" and this is just an example of how 3C lets us do that while almost everyone else (although it's a small pool this week, we are still in just about the top 1%) is chasing prices which is the last thing you want to do in a market that is this unstable because, as I have mentioned and have featured here, 1 or 2 months of gains can be taken out on an overnight gap or 1 day of trading action so all of those people who were chasing the market and seeming "winners for 1 or 2 months lose it all and often more in moments or what is a flash in market time.

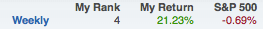

#4 of 328 with a 21+% return for the week on the overall options tracking portfolio (I say tracking because I use it to track various positions, it's different than a trading or "model" portfolio as I would not trade all of the ideas that I put out for our various members because of excessive correlation, too much open market risk and other issues that are not favorable for model portfolio performance).

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment