If you have need of an energy position in crude specifically which should suffer as a result of a stronger $USD, then I like either short USO of long SCO (2x short Crude).

I don't have a problem adding them here or adding to them, I wish I could. I think SCO may move to the $37 area, but the thing is once the herd is broken up and they start selling any and all strength, the market is going to crack-we are at the VERY UnPREDICTABLE part of the market.

I thought I had a great signal on AAPL and let go of my short to add at higher levels, then the hedgies sold any and all strength in AAPL and it cracked and 45% lower, I had perfect position and good signals, but all bets are off once everyone is acting, not just in their own self-interest-but acting on their own fear-more importantly.

That is why I'm not opposed to SCO long or USO short right here as a new or add to position. Adding a partial position is an idea I like too, if price moves lower (for SCO long) you can add to-you are not dollar cost averaging because you planned this in your risk management before you ever entered. If price takes off to the upside, you have a wide stop and can add on a pullback later,

5 min looks really bad with price action so fractured, I believe that's more a sign of smart money's fear than anything.

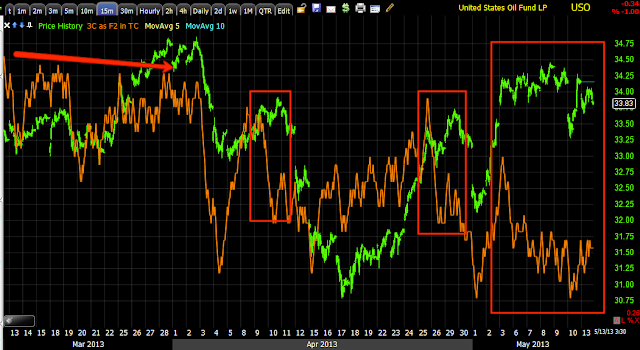

USO 15 min is in a horrible negative divergence.

USO 60 min tells the story.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment