It sure looks that way, no one wants to be caught holding Friday's inventory at those price levels (especially the middle men) and then have a surprise downside move Monday.

USO 1 min seems to be turning down now.

5 min is inline still, but the way it goes is weakness in shorter timeframes moves to longer.

Overall the 15 min is unchanged so it does appear to be a gap fill, this is a close up.

This is the wider view of the 15 min

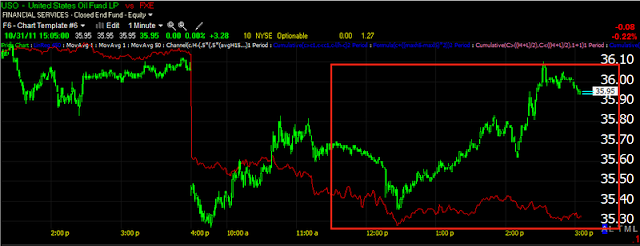

Here's a total mismatch of any type of correlation whatsoever. (USO vs EUR)

And here's what looks like churning volume at a gap fill and some downside volume building in.

I just took a quick look at USO for changes since starting this post and it does look like the downside volume and price pace are picking up, making this a successful gap fill for someone.

No comments:

Post a Comment