First the market has been diligent about not holding early losses like today, not this long and almost never on a close. Second the market has been diligent about filling gaps, if either of these change, we have a definitive change in character, but as you know, I've been expecting that this week.

Here's te update and why it's difficult.

You can see the 1 min DIA negative divergence from late yesterday, the 1 min chart has been choppy and I suspect there's been some small accumulation in there, but this doesn't look at all like the kind of 1 min positive divergences we always see. For me, this is a change in character and my first inclination is to say that there won't be a strong end of day move as has been the norm, but perhaps this is being gathered for a gap fill tomorrow and as you know we have the I-pad launch 3 tomorrow and you probably remember my thoughts from the earlier AAPL update (it is still within range to put in a stronger head fake move then what we saw yesterday).

On the 2 min chart it seems like we are seeing the culmination of all the smaller 1 min positive divergences, I would guess this may be for a gap up tomorrow.

We see the negative divergence yesterday and a 5 min positive divergence today, again, because of the lack of a strong 1 min, I feel it is more likely to be a gap then a late day recovery attempt, but as you saw, Credit and risk assets are all selling off hard. With divergences only out to 5 minutes, some bad EU news could probably overwhelm them, but I'm not expecting that until Thursday, although we have already heard leaks that the PSI can't garner even 70%.

The DIA 15 min chart over the last week or so looks as it should, 3C is in line with the move down, no positives here at all.

Usually when the normal charts we look at are ambiguous, ES gives a decent signal, not today...

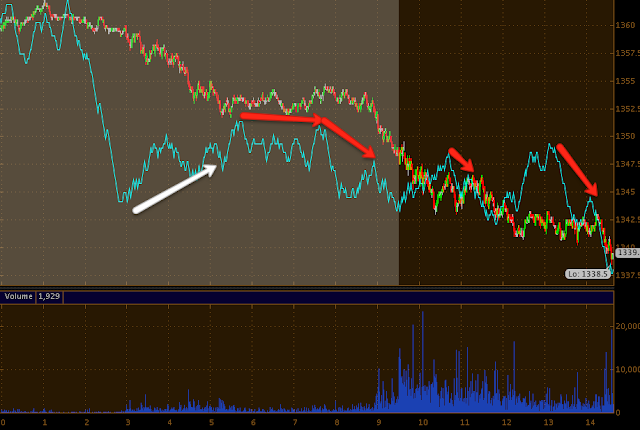

Here's ES pre market with a few decent signals and during market hours, I don't see a positive divergence here at all. These are much bigger contracts so it may be the risk off mode is effecting ES more then equities. You don't want to get caught on the wrong side of an ES trade.

The IWM IS showing a 1 min positive divergence like I would expect to see, this bothers me that I'm not seeing the same in all of the averages.

The 2 min here has some positive divergence but they are not as strong as the DIA's.

Skip to the 5 min and we do have a decent looking positive. This again tells me this is more set for a gap up move and maybe the AAPL breakout I'm looking for rather then end of day upside momentum, we'll find out very soon. In any case, a 5min of this size could be good for a move of a day or two, so that may reflect on the AAPL move I'm looking for or hoping for as a signal (head fake move).

Boy am I glad I closed that QQQ put when I did this morning. I got out right at the top for a nice gain for an hour. However, again, no clear 1 min trend which if I saw, I'd be inclined to say we see end of day upside momentum.

There's no 2 min divergence at all.

On the 5 min chart there is a slight positive, gap fill? That's what I'm thinking which could set up the AAPL head fake move.

The SPY 1 min has seen some more positive divergent action later in the day.

The 2 min is leading, but not VERY strong.

And confirming the end of day divergence on the 1 min chart, we see it here on the 5 min. There is a chance this could build even longer, like in to tomorrow, I don't think it is high probability, but it's possible. The AAPL event would argue against this in my opinion.

As for AAPL, there's a late afternoon positive divergence here. There also was a smaller one around the open.

AAPL 2 min and yesterday's very small head fake move outside the triangle which was clearly negative sending AAPL lower for a nice quick trade. However the 2 min here is simply in line with price, possibly slightly leading.

The 15 min is where the real weakness in AAPL appears to be, other then the 30/60, but 1 bridge at a time.

NYSE TICK today has been very negative, w haven't sen this in months, lots of sub -1000/-1500 moves and very few greater then 750.

I think at the close, the price volume relationships will be dominant and I would expect that they would be short term oversold, so that again argues for a bounce in to the gap and if we get that, then there's no reason we can't get the AAPL move.

For longer tem members, you know what these charts normally look like and I'm sure you can see the difference too. I look at this as a change in character and not for the better, much worse, but a I said, even a headless snake can move around quite a bit.

No comments:

Post a Comment