Commodities intraday are closer to the EUR/USD correlation than stocks are at this point.

Long term, here's the negative divergence in the SPX top area as Commodities severely underperform equities, this is not viewed as a healthy risk on move.

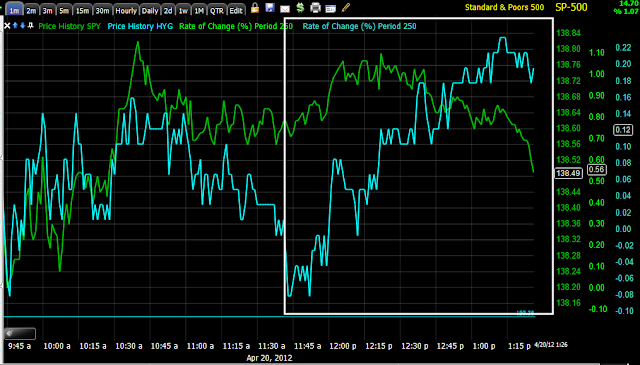

HY Credit is roughly moving wit the market today.

Longer term, it refused to make any higher highs since early February. More trouble for the market.

Yields intraday have diverged negatively, it looks like equities are moving with Yields a bit here, although I wouldn't think they would be so influential today. In either case, the intraday divergence is not good news for the market.

The longer term divergences is very big, equities tend to gravitate toward yields.

Here's that EURO break out in white from the last post, the market has diverged from the EUR correlation, although at the moment it is offering the market some head space above.

Longer term, the correlation has fallen apart totally as the Euro makes lower highs, refusing to follow the SPX.

This is a curious chart, although intraday and it could change quickly, Corp. Credit seems supportive here of some further gains intraday in the SPX.

Longer term, the trend in credit is clear, lower highs/lower lows as the market drifts laterally in very volatile fashion, exactly like a top would behave.

The intraday sector rotation is falling apart in most cases, defensive sectors are showing better relative momentum, Financials and Tech are falling off .

Industrials and Basic Materials are the only two risk on groups still holding up, Financials, Tech, Discretionary, Energy are all falling off while defensive sectors are rotating in, Healthcare, Utilities and Staples.

IT seems the internal intraday structure of the market looks pretty poor, but this is what we expected and why I'm looking to short strength.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment