This is a much tougher one to call (no pun intended), but higher is clearly not the direction of more pain, unlike the SPX. Where max pain is exactly, I'm not sure one can say.

AAPL Calls/Open Interest.

The open interest here seems to be thicker between $590 and $655, so I would think they won't want to be taking AAPL much higher.

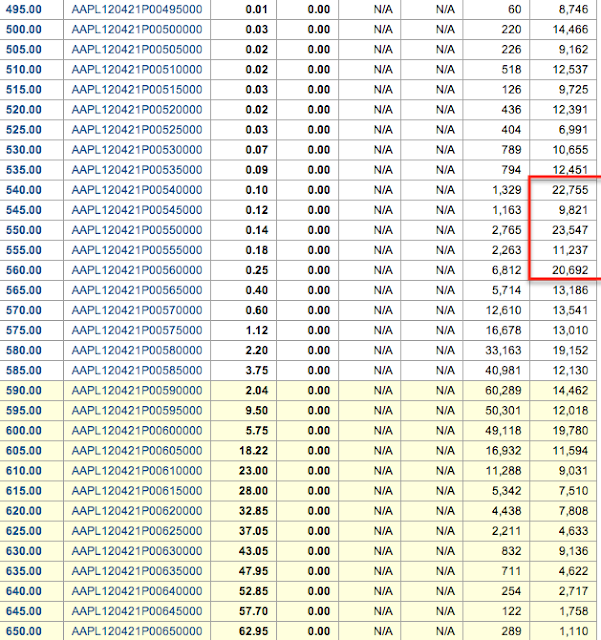

AAPL PUTS/ Open Interest

The $540-$560 area has a chunk of open interest,

It almost seems as if AAPL is right about where it should be for an op ex pin. Without crunching all of the open interest it's difficult to tell, but taking AAPL much lower than $585 doesn't do much to knock out Calls and it would just allow higher Put open interest at those levels to be in the money.

Honestly, I don't see much reason to move AAPL too far from where we are, $5 here or there.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment