***This post was started just before the last post re: adding to spec. IWM/QQQ Weekly Calls (expiration next Friday)

Still Chugging long and I'm even considering adding to the call positions, if I were going to be able to watch through the close I probably would, I still might.

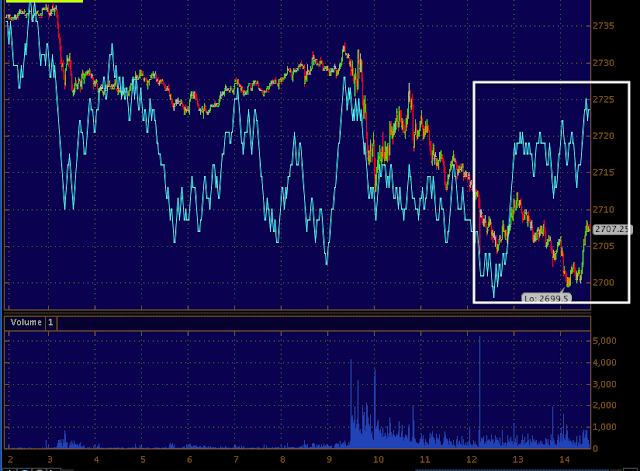

ES, while not my favorite (SPY) is leading 1 min

ES 5 min has a large relative positive and a leading positive, this is about the size of divergence we have been taking these weekly option trades on.

NQ 1 min leading positive-this one is the one I like , the Q's and IWM

5 min large relative positive and leading positive.

DIA support and a FLAT range, perfect for accumulation, the yellow arrow is the break, stops and short orders triggered as volume rises, this is the igniter for a reversal as stops allow accumulation at lower prices and wit some supply and locking in shorts creates automatic demand as they have to cover when price reverses adding to upside momentum.

DiA 5 min(this is significant for a small move) leading positive divergence.

IWM 5 min leading positive, 5 min is the first timeframe outside of intraday trade and in to institutional.

IWM is flat in a range today and breaks support, volume kicks up.

QQQ 10 min leading positive, most of it around the move below support, this is a good signal for the size trade we are looking at.

QQQ 3 mi is sharper as a shorter time frame, leading positive clearly.

Q's break of support, the head fake move or failed move, "Failed moves turn in to fast move".

SPY 5 min leading positive, again not my favorite, but good enough.

SPY support and the head fake hitting stops, committing shorts.

NYSE TICK has not hit extremes, but why would it considering price action, what is important is the highs at lower moves.

THE 5 MIN 50-BAR MOVING AVERAGE WILL BE KEY HERE, ONCE PRICES MOVE ABOE IT, MOMENTUM SHIFTS.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment