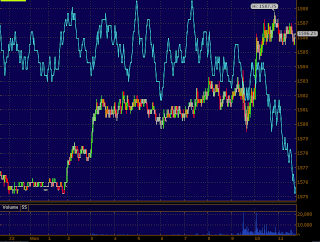

Before I get to AMZN, just check out the ES (SPX futures) intraday chart, it need no annotations from me.

I still have the AMZN May 13th $250 calls as an open position and still like it, regardless of market expectations. AMZN has went from a downtrend-quite sharp, to a lateral trend, as you know I often say, "Reversals are a process, not an event"; this is largely because of the size of institutional positions and the time it takes for them to get a position together as they can't do it all in one order like we can becausew of the size. That being said, for a parabolic move down, even the movement today is about in line with what I'd expect from a reversal process.

Here are the updated charts...

The intraday 2 min AMZN positive divergence...

The 3 min is seeing migration from the 2 min so that's good and we have a leading positive divergence (the strongest kind).

The 10 min, as mentioned Friday, never confirmed the price low, it had more than enough time to do so and still won't. Also the rounding here is proportionate to even a dead cat bounce reversal space.

The 30 min chart isn't saying AMZN is a screaming buy, in fact you know I want to short it in to strength, but the recent drop is not confirmed here either, instead we have a relative positive divergence.

Even momentum is turning positive, the momentum indicator, RSI (setting6/1) , MACD (setting26/52/9) and Stochastics (setting 50/3)

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment