There are some interesting trends that I believe are just starting to really get under way including a higher Yen and dollar, a lower AUD and likely Euro. All of these would be market negative.

As for the confirmation I found here in currencies (I still want to look at Leading Indicators and Bellwethers), it looks just like the averages, but there's still good information here as the 5 min futures chart is more like the 15 min 3C chart we use on stocks, it's a stronger signal.

Euro 1 min is not confirming just like the 1 min charts of the averages

The Euro 5 min though is leading negative, like the longer charts of the averages. This essentially tells us that intraday trade is likely to remain volatile with a lot of shakeouts, but the overall character of trade is negative and the direction is shifting to down ass a negative move in the Euro is a negative environment for stocks.

USD 1 min had a positive divergence pre-market, it took off to the upside from that divergence but has an intraday negative here, like the market averages not confirming on the 1 min chart.

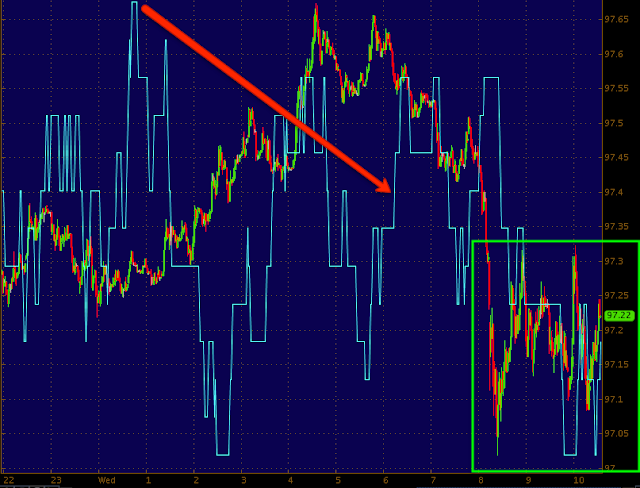

The 5 min $USD chart though has a stronger positioned leading positive divergence, finally the pullback from the $USD's large (completed) "W" base looks like it's getting ready to end and continue to a stage 2 breakout for the $USD, VERY market negative.

The AUD 1 min with a positive divergence in to the drop, it did get a bit parabolic toward the end as I suspect stops were run. The problem here as the AUD has been the most non-commital of the currencies is that overnight Australian PMI came out, it was a disaster, dropping from 44.4 to 36.7. The RBA was widely seen as "Wait and see mode", now they see and it's not good.

Still the 5 min AUD is in line and...

The more important 15 min that had been the most non-commital of all currencies as no one knew what the RBA would do until economic data came in, is now one of the most aggressive 15 min charts with a sharp leading negative divergence in no time at all.

The Yen 1 min is in line at best, if that.

However the 5 min is perfectly in line, the uptrend looks solid, again, intraday volatility, but the underlying trend in this case is market negative, actually in every case of all charts above and almost all below.

EUR/USD with a sharp negative divergence at the overnight highs.

The Carry pair of EUR/JPY also with a sharp negative divergence at overnight highs, this is a market negative when losing ground and both the Euro and Yen individually look set to continue this trend.

The Carry pair of USD/JPY is in line, this one has me unsure because both currencies look to rise, neither rising is good news for the market so I don't know what this pair does, I suppose it depends on relative performance between the two currencies, either way, I doubt this remains a viable carry trade.

Finally the Carry pair of AUD/JPY is losing ground, it has the short term signal like the market and the 1 min currencies above, but the longer trend as seen in the AUD and JPY seems to suggest this keeps losing ground which is bad for carry traders, especially the ones using 200:1 leverage.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment